How to Give Better: Community Foundations, Private Foundations, and Donor-Advised Funds

Did you know that the majority of wealth in America is held outside of checking and savings accounts? As a client, you are most likely familiar with the fact that we encourage you to not keep too much money in cash so inflation doesn’t erode your purchasing power over time. This means that we direct your investable net worth into investments within:

- qualified retirement plans, like 401(k)s and 403(b)s,

- individual retirement arrangements, including traditional and Roth IRAs,

- health savings accounts,

- taxable brokerage accounts,

- real estate,

- and/or alternative investments.

We’re not the only financial planners who recommend these savings strategies. This means that large amounts of overall wealth consist of assets instead of just cash. And for those who are charitably inclined and wish to do more in the philanthropic world, giving cash — especially when planning large gifts — can be an inefficient way to give back.

How You Can Efficiently Give

Planned giving to charitable organizations can help them improve their philanthropic operations, but it’s also an opportunity to allow your own generosity to benefit you and your financial situation at the same time.

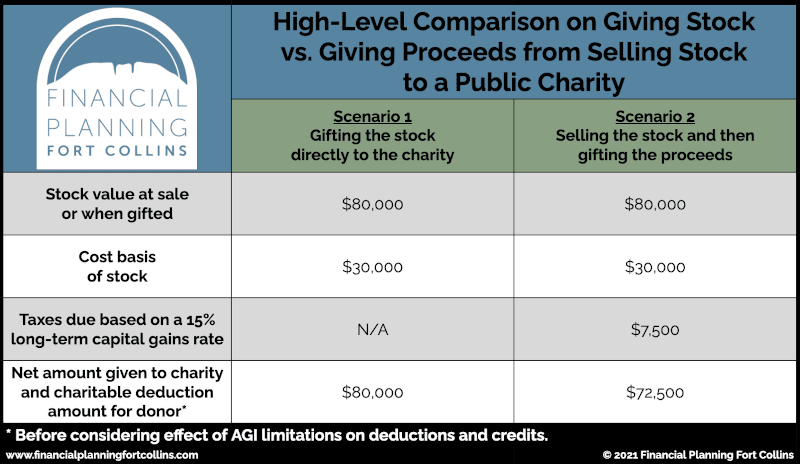

To provide a high-level example: Say Jordan wants to give an $80,000 stock position to their favorite charitable cause this year. They paid $30,000 to acquire this stock several years ago. Jordan and the charity can both benefit with a little planning.

As you can see in this example, giving the stock to charity allows Jordan to direct more money to the charity and also prevent a taxable event if they sold the stock position.

Planned Giving Strategies

Just like this example above, incentives exist in the tax code — income, gift, and estate — and certain tools can help you enhance your charitable giving.

If you’re charitably inclined, it can be difficult to know where to start planning. Luckily, you may have already heard of or considered some organizations and vehicles.

▶︎ Community Foundations

For those interested in getting plugged into a philanthropic system, community foundations offer potentially great opportunities to learn, network, and receive support throughout the philanthropic journey. These can be great for those who want to be part of a community and lean on the support of philanthropic experts.

Most community foundations are geographically based and act as a philanthropic hub for the area. To find one in your community, you can go to the Council of Foundations website. These organizations can be great opportunities for donors to learn how to give in efficient ways while also networking with other community stakeholders.

A community foundation typically offers a wide range of services like:

- donor-advised funds,

- scholarship funds and administration,

- endowments,

- donor education and networking opportunities,

- grant assistance,

- screening nonprofits and research,

- and family philanthropy support.

Another style of community foundation doesn’t solely focus on a region’s philanthropic needs but is a way for people who share a similar identity. Some examples include the Women’s Foundation of Colorado, Asian Pacific Fund, and the Center for Arab American Philanthropy. So if you’re interested in joining a community of philanthropists, consider community foundations as a potential launching pad in your philanthropic journey.

Private Foundations vs. Donor-Advised Funds

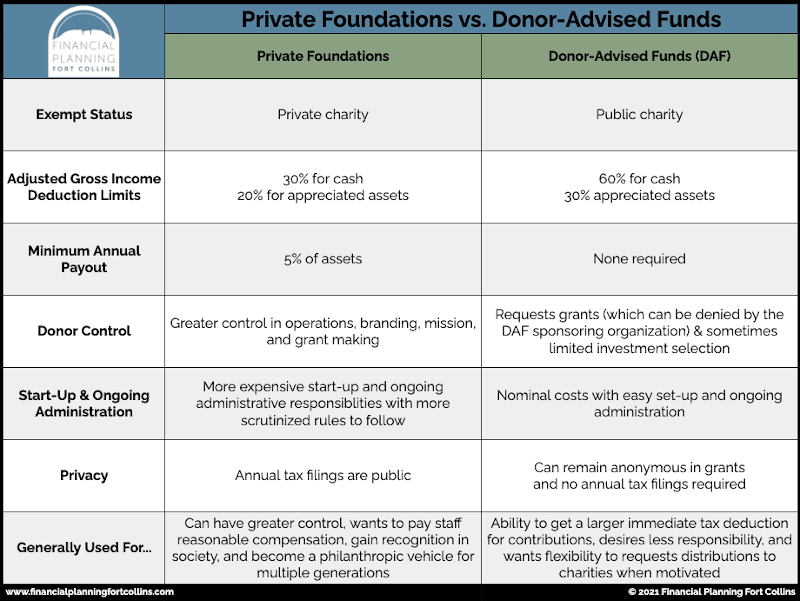

These two charitable giving vehicles are typically proposed by advisors for many donors, and it can be hard to know the difference. Both of these vehicles can accept cash and non-cash contributions, but they have different income tax deduction limits.

▶︎ Private Foundations

For those who wish for greater control in their philanthropic endeavors and have a significant amount of money that they want to irrevocably earmark for charity, private foundations are worthwhile considerations. However, with a history of abuse, these private charities are under more government surveillance with more rules to follow — and steep penalties exist for self-dealing practices and other types of mismanagement.

The benefits of this complicated charitable giving tool are:

- control over assets and operations,

- the ability to wield influence in the philanthropic space (like the Ford Foundation with around $12.4 billion), and

- its use as a multi-generational planning tool to keep the family together around a philanthropic goal.

▶︎ Donor-Advised Funds

Another popular tool in the charitable giving space allows donors to make an irrevocable charitable contribution to a sponsoring organization. Sponsoring organizations are typically community foundations or another charitable organization like Fidelity Charitable, Schwab Charitable, Vanguard Charitable and others. Donors then recommend grants to public charities when they feel motivated to give.

The startup, ongoing administrative responsibilities, and related expenses are significantly less than those associated with private foundations. And donors have the choice to remain anonymous in the grants, so they don’t have to worry about ending up on the charity’s contact lists for future solicitations.

These tools also allow:

- larger charitable income deductions than private foundations but have the drawbacks of less prestige,

- some limitations to investment selection, and

- the possibility that the sponsoring organization will reject a grant request (though this is uncommon for the larger sponsoring organizations).

Comparing Private Foundations and Donor-Advised Funds

For a high-level comparison of these two tools, please reference the chart below. We also encourage you to discuss your intentions with us and your estate attorney so we can help you identify which charitable giving vehicle may make the most sense for your unique situation.

If you’re wondering how you can get started with charitable giving, head to our Meeting page and schedule some time to get together. We’ll spend some time discussing what’s most important to you and how you want your generosity to make a positive impact on the world. Then, we’ll implement your strategy in the way that makes the most sense for your wishes and the causes you care about.

Not a client yet? See if our ensemble approach is right for you.

This article is a preview of the FPFoCo Academy module “Advanced Charitable Giving Strategies.” Head to the FPFoCo Academy to log in and experience the full module!