Simplify Your Financial Life Administration

Functioning in today’s society requires a variety of skills and to-dos. Life asks a lot of the modern-day person in our first-world settings. Unlike physical labor around your home, you can only accomplish certain tasks by having some sort of knowledge.

To check some off your to-do list, you sometimes need to know which person to call, the account number required for access, the relevant background information, or the fact that it’s best to ask for the service department instead of customer support. That’s why some tasks aren’t easy to delegate and why you have to accomplish them yourself. Here are some examples of these types of tasks:

Treat Yourself for Accomplishing Life’s To-Dos

- Paying your rent or mortgage,

- filing and paying your taxes,

- paying off your credit cards every month,

- registering your vehicles,

- updating your estate plans,

- signing up for your employee benefits during open enrollment,

- filing for your new child’s Social Security number,

- filing for Social Security,

- enrolling in new insurance, and

- the list can go on and on.

Phew, just typing that list was exhausting! Unfortunately, accomplishing these tasks often feels like a “thankless job,” and you have to do them to stay in some form of “good standing” — be it with the government, your personal finances, your household, or society in general. Nobody rewards or pays you to do these jobs. You just have to do them. These tasks are sometimes described as life administration.

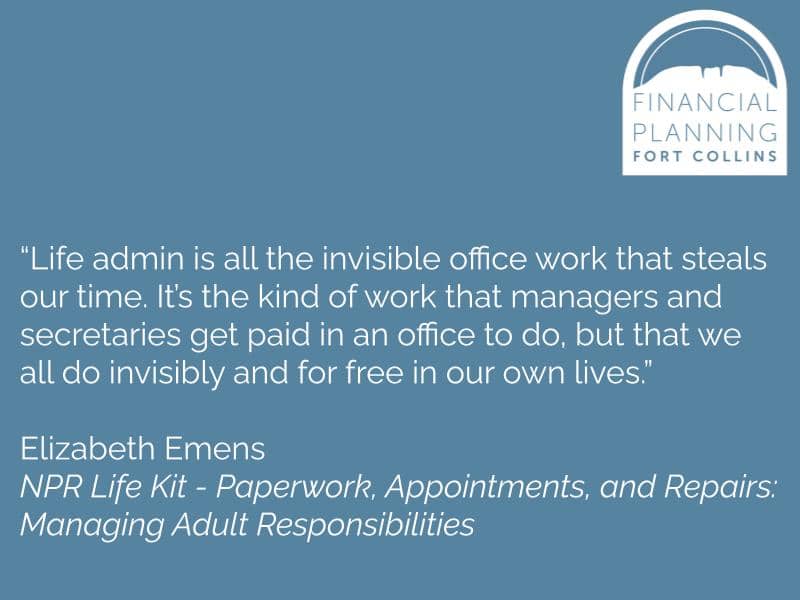

Life administration involves all kinds of to-dos like changing the air filter on your furnace, cleaning the gutters, winterizing the sprinklers, planning birthday parties, booking air travel, going grocery shopping, and so on. Elizabeth Emens, a Columbia law professor, wrote a book called “Life Admin.” In an NPR Life Kit interview, she gave this basic definition:

To prevent yourself from getting bogged down in the details of life’s responsibilities, we’ll provide some guidance to help you tackle your financial life administration in our latest FPFoCo Academy module.

These are the administrative tasks that fall under the umbrella of personal finance — like insurance planning, estate planning, budgeting, retirement planning, bill paying, and the like.

In the module, we’ll provide information on …

- How to get your financial house in order,

- three steps for managing your bills,

- going paperless: digitizing your documents, and

- a financial life administration checklist with rewards!

Head to FPFoCo Academy to log in and get started. And if you have questions along the way, don’t hesitate to reach out. Or use your unlimited meeting and consultation time and let us help you through some of these life to-dos.

Not a client yet? See if our ensemble approach is right for you.