Who doesn’t love having a little extra savings stashed away? Sure, it can increase a little too much from time to time. (And we’re here to help you make the most of it when that happens!) But what about when it sneaks up on you?

Not literally, of course. I’m talking about savings creep. Never heard the term before? That’s ok. I made it up. And it’s the opposite of lifestyle creep. What’s that? Keep reading. It’s the first reason why you’re going to love savings creep — and why I do, too!

💗 Savings creep #1: It’s not lifestyle creep.

If you’re not familiar with lifestyle creep, let me explain. Lifestyle creep happens when your income increases … and then your spending does, too.

- Another common term for “lifestyle creep” is “lifestyle inflation.”

Say you get a raise, but then you start to increase your spending. Not just once to congratulate yourself but on an ongoing basis. Sure, you continue contributing to your 401(k) and stashing some savings. However, you don’t increase those amounts in proportion to your raise.

Think of it this way: You were saving 10% of your income. And while your income has increased, you’re still putting the same dollar amount into your savings. So now you’re only saving 9% of your income. You’re still saving, just not at the same rate. And if you’re not saving additional income, you’re probably spending it.

That’s lifestyle creep.

So what if you took the opposite approach?

Let’s say you earned that same raise but, instead of saving at the same rate and increasing your spending, you increased your savings and spent at the same rate. You’re still living the same lifestyle, you’ve got a comfortable standard of living — but you’re upping your savings.

For example, many people can “up” their savings on an annual basis by configuring automatic increases in their employer-sponsored retirement accounts, like 401(k)s, 403(b)s, and so on. By simply checking a box when you enroll in your retirement plan, you can allow your savings creep to happen automatically over time.

💗 Savings creep #2: You might not even notice it (until you do).

There you are: You’re living that comfortable life, and you’re not missing out on anything.

Then one day, you check your savings account balance and … whoa! Your savings crept up on you.

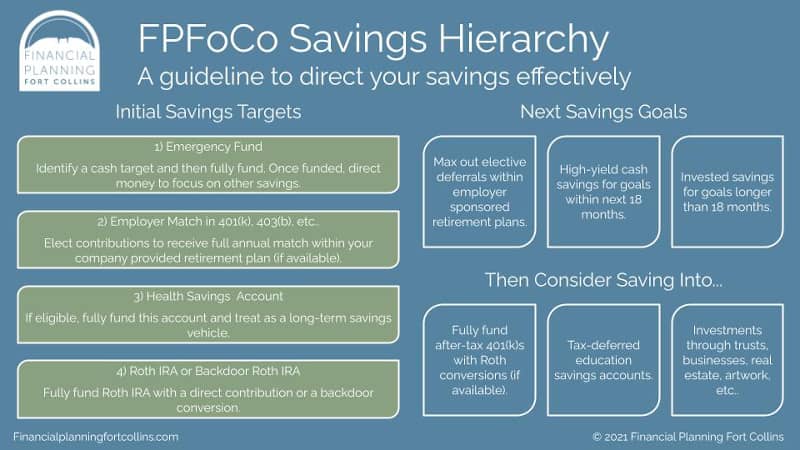

It might mean that you’ve hit the mark on your emergency/opportunity fund. Or maybe you’re ready to start filling up the next “bucket” in the savings portion of your financial plan.

If you’re not sure where your savings should go next, let’s talk. We can discuss the financial and nonfinancial reasons for making that next move so you can be sure it suits you.

And with the magic of compound interest over an extended time, your savings creep can potentially double and even triple the amount of money you have. You earn interest on your interest in the background because of your initial savings.

Are you loving savings creep yet?

💗 Savings creep #3: Nobody else has to know, either.

If you’ve completed a Building Wealth assessment and reviewed the results with Dan, he may have mentioned The Millionaire Next Door: The Surprising Secrets of America’s Rich. In fact, it’s one of our favorite books. It’s all about research that authors William D. Danko and Thomas J. Stanley did — and their interesting findings.

What did they find? That the majority of millionaires in America don’t live in prestigious communities but in middle-class neighborhoods. Instead of flaunting their wealth, they preserve it — often without most others knowing that they’re wealthy.

If savings creep is starting to grow on you, you may want to borrow some ideas from these millionaires. Keep your housing costs low relative to your income. Drive that old car into the ground (figuratively, of course!). And keep stashing your savings so it can creep up on you!

💗 Savings creep #4: It gives you more flexibility.

That stashed savings can offer you more choices.

For example, think of buying versus leasing your next vehicle. Without excess savings, leasing might be your only option. With savings, you could go into the financing office at the dealership and offer to pay cash, but you might also find other options.

You could buy outright, lease at a low interest rate, or leverage financing to get a better deal overall on that vehicle. Don’t forget: Even if you could buy your next vehicle with cash, you could also look at interest rates. If you find a rate that’s markedly lower than what you could reasonably expect to earn in your investment account, you might take the financing and invest beyond your down payment for a better overall return.

And if you’d prefer to pay cash so you won’t have the debt on your balance sheet, that’s ok, too. There’s that savings creep flexibility!

💗 Savings creep #5: It can help you reach your goals more quickly.

Didn’t realize you had quite that much in your savings account? You can deploy the extra savings you didn’t know you had to reach goals you didn’t know you could achieve yet.

If it’s time to check that next goal off of your list, let us know. We’ll take a look at your RightCapital financial planning app together — and celebrate your accomplishment!

How to Make Savings Creep Happen

Now that you’re loving savings creep, here’s how you can start letting it sneak up on you.

Live within your means, even when those means become more meaningful. If you get a raise or higher-paying job, stick to your old outflows. Auto-deposit the increase in a separate savings account so you don’t even see it. You’re not any worse off, but your savings is better off.

Similarly, don’t count your chickens before they hatch. Base your budget on your regular income — not future gifts, bonuses, etc. Stash those away, and let your savings creep up on you.

Embrace an attitude of gratitude. Instead of reaching for that next best thing, spend some time thinking about what you have and why you’re thankful that you do. This can help you avoid spending time thinking about what’s missing in your life and instead enjoy what’s present. So let some dreams remain dreams — instead of turning them into goals. There’s nothing wrong with living quite modestly and nothing shameful about enjoying life’s little luxuries.

Remember that money can’t buy happiness. In fact, when it comes to income, “happiness flattens significantly after $100,000; at even higher levels there is very little extra well-being to be had with more income.” That doesn’t mean there’s anything wrong with earning more than that. And if you do, you can limit your spending and live a $100 grand lifestyle that’s still quite … grand!

Practice mindfulness when spending. See “Embrace an attitude of gratitude” above. And focus on using money to bring things into your life that truly make you happy.

After the savings creep in, avoid losing those dollars to inflation. Instead, give them the chance to creep up a bit more by investing appropriately.

Let us lend a hand so you can make savings creep part of your plan!