To help you gain confidence and to develop systems as you improve your money habits, why not learn from others who make careers in helping people make better financial decisions?

Behavioral Economics

Economic textbooks historically include charts and stories about

- supply and demand,

- efficient markets,

- the invisible hand,

- gross domestic product,

- inflation, and

- many other exhilarating subjects.

Have we put you to sleep yet?

An emerging field of study makes finances more relatable by making it personal. This field, called behavioral economics (aka behavioral finance), examines how individuals make decisions about their financial lives.

Its proponents conclude that people make decisions that aren’t always in their best interests. So it’s best to design systems that lead people toward better outcomes.

As our client, you have access latest to our personal finance module titled, Money Habits & Behavioral Finance. This module goes into detail about how you can better understand and improve your personal financial life, how to create systems to simplify your decisions, and also some personal stories from our team on how we’ve all made money mistakes in our lives.

The rest of this article gives you a glimpse into part of this recently released module!

7 Irrational Money Behaviors

1) Loss Aversion

According to behavioral finance researchers, losses feel two times as powerful as an equivalent gain. Negative events prove memorable, which can lead you to not taking on risk in the future. People still feel the pains of the dot-com bubble, the great recession of 2008, and the 2020 stock market pullback, yet aren’t referencing the positive return years — which happen more often than the negative pullbacks.

As of writing in December 2020, the financial markets are near all-time highs again. Do you envision that we’ll see all-time highs in the future? That’s why investors choose to invest: because they feel that the valuations of the companies represented in the financial markets will continue to increase shareholder profitability.

Yet the scars of previous financial market pullbacks cause many investors to be more conservative (aka loss averse) because they don’t want to see their accounts lose value. This causes them to choose conservative portfolios — or even holding their money in cash — thus running the risk of losing purchasing power due to inflation.

▶︎ Ways to combat loss aversion

Understand your risk tolerance by referencing our online questionnaires, like the one linked below. These reports give you data on how to position your investment portfolio and your personal risk tolerance. You can then position your portfolio into a suitable investment strategy based on data instead of relying on your emotions.

This quick test is designed to show you how you’ll react to volatile markets.

lnvestor Composure Survey

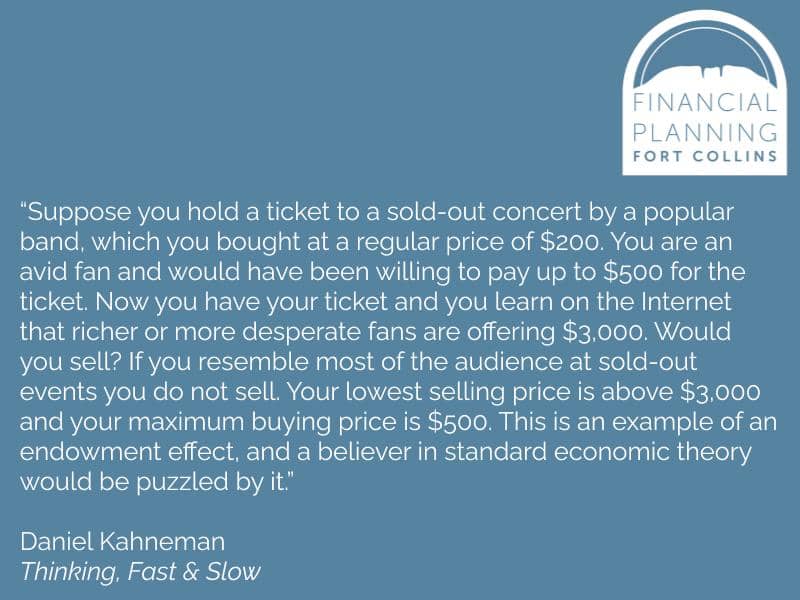

2) The Endowment Effect

People become attached to what they already own. Thus, they make irrational decisions to justify the reason for owning the item or to continue the course of a previously made financial decision.

Nobel Prize-winning economist Daniel Kahneman did extensive research on this endowment effect and wrote about it in his book “Thinking Fast & Slow”:

You may have seen this in your own life or witnessed other people continue throwing money at problems so they can at least get back to their cost basis or stubbornly want to prove they made the right historical decision.

▶︎ Ways to combat the endowment effect

Envision starting anew. Would you make the same financial decision again? Would you put “new” money into the situation or pass on the investment? This mindset can allow you to remove the emotional attachment of your “old” money already spent or invested.

3) Mental Accounting

Mental accounting refers to how your brain compartmentalizes separate financial decisions, sources, and accounts from each other. Money is fungible, meaning that a dollar is worth a dollar no matter where it came from or where it’s placed. Yet our brains tend to compartmentalize money into categories.

For example, many people who receive bonuses or windfalls tend to place a different value on and behave differently about the money. Like justifying a new expensive purchase because this money was “extra” to their regular cash flow.

▶︎ Ways to combat mental accounting

Utilize your access to the financial planning app RightCapital to see how specific decisions can influence multiple areas of your financial life. This helps you see the big picture as you analyze tradeoffs between different financial decisions.

Another strategy can be to take a step back and ask yourself, “If this windfall was part of my monthly salary, would I be treating this money any differently?” This mindfulness can help you realize that you can value money the same way, no matter the source, and can treat it with the same intentions relevant to your money life.

4) Future Discounting

People procrastinate and hope to become more responsible later. It’s easier to be responsible tomorrow instead of today. Yet making sacrifices today for an unknown person in the future confounds a lot of people.

This leads them to not take their future selves seriously, thus discounting their overall significance when compared to their current wants and needs. Our brains are wired for this immediate gratification, but you can design systems to help you save for your future.

▶︎ Ways to combat future discounting

Envision your future self. You can give your future self a name and/or vividly describe how you’re making decisions to benefit this person.

You can list out …

- how you’ll spend your days in retirement.

- where you’ll live.

- what you’ll look like.

- what you look forward to in your retired lifestyle.

Once you make this future self more real in your mind, you can become motivated to save money so this person can have a more comfortable living.

Pro Tip: Set up automatic transfers so you can save for your future self on a recurring basis. To be even more responsible, schedule automatic step-ups in your contributions on a recurring basis as well.

5) Overconfidence

You made a few stock picks that increased in value. You begin to think you’re getting pretty good at this, which leads you to start making riskier trades. Everyone feels like they’re an above-average driver, and many people believe they’re above-average investors. This can lure people into challenging financial circumstances after a series of overconfident financial decisions.

Even active investment managers who invest for a living don’t have the “secret sauce.” According to Morningstar’s Active Passive Barometer report in June 2020, “actively managed funds have failed to survive and beat their benchmarks, especially over longer time horizons; only 24% of all active funds topped the average of their passive rivals over the 10-year period ended in June 2020.”

▶︎ Ways to combat overconfidence

Imagine potential outcomes. Behavioral economists describe this exercise as a “premortem.” When making financial decisions, analyze why each potential decision does and does not meet your expectations. This can help curb the excessive optimism that arises when someone gets too excited about their abilities to make the “right” financial decision.

6) Confirmation Bias

People can anchor their viewpoints and philosophies once convinced. Or the viewpoint can become rooted in the person’s identity. This behavior sways people into irrational decisions because they tend to seek out information that supports their viewpoints versus being exposed to alternative opinions.

You can see this when people become excited about a potential future financial decision. Instead of taking a step back and contemplating how the decision fits into their financial goals, the person can find ways to justify that their desire to move forward is the right decision.

▶︎ Ways to combat confirmation bias

Play the devil’s advocate and analyze the pros and cons. What are others who are making the opposite financial decision saying? Focusing on your own financial viewpoints can put you on a linear path toward ultimately making the decision. Give yourself some potential mental off-ramps to make a different decision.

Take a step back and analyze alternative viewpoints and options as well as the pros and cons of those decisions. You can then either make your original decision with confidence or explore another option.

Pro Tip: We provide a worksheet later in this module to help you go through this process.

7) Herd Mentality

If everyone’s talking about it, it must be a good thing, right? The fear of missing out (FOMO) surfaces many times in financial markets. Prices accelerate and people want to get into the action before it’s too late. We’ve seen this happen with Tulip Mania in the 1600s, the Japanese markets in the 1980s, beanie babies in the 1990s, the dot-com bubble in the early 2000s, and the housing crisis of 2008. And we’ll likely continue to see market bubbles in the future.

We can’t prevent market bubbles, but you can intentionally expose — or avoid exposing — your risk to a future bubble.

▶︎ Ways to combat herd mentality

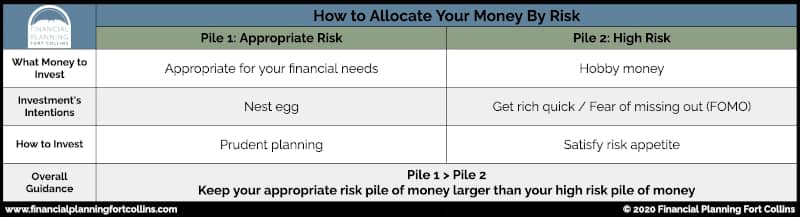

Once you become interested in an investment trend that’s new to your existing investment strategy, ensure you keep your risk piles in the proper balance.

You have assets in your financial net worth, and you want to make sure your appropriate-risk pile is bigger than your high-risk pile.

This is especially true when we hear clients wanting to stock-pick or follow trends like cannabis, robots, artificial intelligence, driverless cars, cryptocurrency, etc.

These trends can prove highly volatile and also have unforeseeable futures. It’s hard to choose the future winners in these emerging spaces, and that’s why we recommend clients treat these speculative investments as a hobby instead of jeopardizing their nest eggs.

We see people get into financial challenges when they have their risk piles in the opposite proportions while following the herds within investment crazes.

Access More Modules

As our client, you have access to the rest of this module — including that quiz I mentioned — and many more personal finance topics available to you. We encourage you to use these educational resources as you build on your New Year’s resolutions.

Please get in touch with us if you have any questions. We hope you have fun combatting the irrational money behaviors explored in this article!