First, let’s review what happens after you die. No, we’re not talking spiritually and the afterlife, we’re talking estate planning — you know, the administrative side of things. Before we get started, you should know that nothing here is legal advice. You should always consult with a qualified legal professional about the specifics of your situation.

The way the legal system handles your estate after you pass is known as probate. Your estate could be simple … or your estate could be complex. No matter the case, the courts need to put their stamp of approval on how to distribute your assets, and you have more control over this process than you may think.

The Order of Things After You Die

In an administrative sense, these are the steps to handling your estate:

1. Estate administration: The first step in the probate process is to open an estate and appoint an executor, administrator, or personal representative.

a. This person’s role is to gather the assets of the deceased person, pay any debts and expenses, and distribute the remaining assets to the beneficiaries or heirs.

2. Inventory of assets: The executor must compile an inventory of the deceased person’s assets and determine their value. This includes all probate assets, such as real estate, personal property, and bank accounts.

3. Payment of debts: The executor must pay any debts or expenses the estate owes, such as outstanding bills, funeral expenses, and any taxes owed.

4. Distribution of assets: After the executor pays all estate debts and expenses, they must distribute the remaining assets to the beneficiaries or heirs. They do this according to the terms of the deceased person’s will, if one exists, or according to the laws of intestacy if there is no will.

a. Intestacy laws differ by state. These are situations in which the courts try to determine heirs to receive the estate’s assets. You can prevent this process by crafting a will and/or listing beneficiaries on financial accounts.

5. Closing of the estate: After the executor distributes all assets, they must file a final accounting and close the estate. The probate process can take several months to several years, depending on the complexity of the estate and any disputes that may arise.

What is Probate?

Probate is a court-supervised legal process that occurs after a person dies. The purpose of probate is to validate the deceased person’s last will & testament (if one exists) and to distribute the person’s assets to the designated beneficiaries or heirs. Probate can sometimes be a time-consuming and expensive process. It is also a matter of public record.

Some estate planning attorneys have mentioned that individuals don’t need to try to avoid probate in all situations. It’s best to consult with your trusted and qualified professionals about what’s appropriate for your unique situation.

What Can Avoid Probate?

Non-probate assets are assets that do not go through the probate process and are instead transferred directly to the designated beneficiaries or heirs.

Examples of non-probate assets include life insurance policies, retirement accounts with transfer-on-death (TOD) designations and bank accounts with payable-on-death (POD) designations.

These assets avoid probate because the beneficiary or heir has already been designated, and the assets pass directly to that person upon the owner’s death.

Assets that have been transferred to a trust also avoid probate. These assets are then distributed per the instructions of the trust, versus being supervised and approved per the probate courts.

What Happens When There Are No Listed Beneficiaries?

When there is no listed beneficiary designation on a retirement or other type of account, the assets in that account will typically become part of the account owner’s estate and be subject to probate. In the absence of a named beneficiary, the assets in the account will be distributed according to the terms of the account owner’s will. If there is no will, they’ll be distributed according to the laws of intestacy of the state in which the account owner lived.

A typical flow of assets follows this path:

Spouse → Children → Parents → Estate

4 Common Beneficiary Designation Mistakes

There are times when your intentions and/or your circumstances change within your life journey. These are good times to review your estate plan, which also includes your beneficiary designations.

Since these designations operate outside of the probate process, it’s critical to confirm that you’re not making one of these common mistakes:

1. Outdated information: You may have named a beneficiary several years ago, but that person may have grown apart from you, passed away, become incapacitated, or changed their contact information since then.

2. Incorrect beneficiary name: You may have misspelled the beneficiary’s name or written an outdated name (e.g.,, a maiden name), making it difficult or impossible to locate the intended beneficiary.

3. No updates since a divorce or separation: You may have named your ex-spouse as the beneficiary, but then gotten divorced or separated. No matter what your last will & testament says, the assets may still go to the ex-spouse unless you update the beneficiary designation.

4. No secondary (aka contingent) beneficiary: You may have only named one beneficiary. If that person is unable or unwilling to accept the assets, the assets may pass to your estate and become subject to probate. This may be misaligned with your intentions.

How do I set up my beneficiary designations with minor children?

Listing minor children directly as beneficiaries can cause problems. This is because, when they reach the age of majority in their state, they can receive the assets outright in their own names. Some people with minors as their beneficiaries understand that a windfall at the age of 18 or 21 can lead to irresponsible youthful decisions.

When taking into consideration any minor children as beneficiaries, consider following these steps:

1. Choose a guardian. The first step in setting up a beneficiary designation for a minor child is to choose a guardian. This person will be responsible for the child’s care if both parents were to die before the child reaches the age of majority. This person is typically designated in a last will & testament.

2. Set up a living trust or a testamentary trust. To ensure that the assets are managed and used for the benefit of the minor child, it may be advisable to set up a trust. A trust can be structured to provide for the child’s needs until they reach a certain age or certain milestones.

a. A trustee will be the person financially responsible and acting as a fiduciary on behalf of the beneficiary: the minor child. The trustee will then distribute the assets per the terms of the trusts. This person can be different from the guardian in charge of the child’s care.

3. Name the trust as the beneficiary. Once the trust has been established, the parents can name the trust as the beneficiary of their assets. This will ensure that the assets pass directly to the trust upon their deaths, rather than being subject to probate.

a. If the trust doesn’t exist until the event of your passing (aka a testamentary trust), consult with your estate planning attorney on the language to include for your beneficiary designations.

It’s important to note that laws regarding the management of assets for minors may vary from state to state. You should always consult with a qualified legal professional who is knowledgeable of the laws in your state to ensure your plans are in compliance.

Tax Implications of Beneficiary Designations and Distributing Assets

When crafting an estate plan in concert with your beneficiary designations, you can go a step further to identify “net amounts” that will be distributed with taxes in mind.

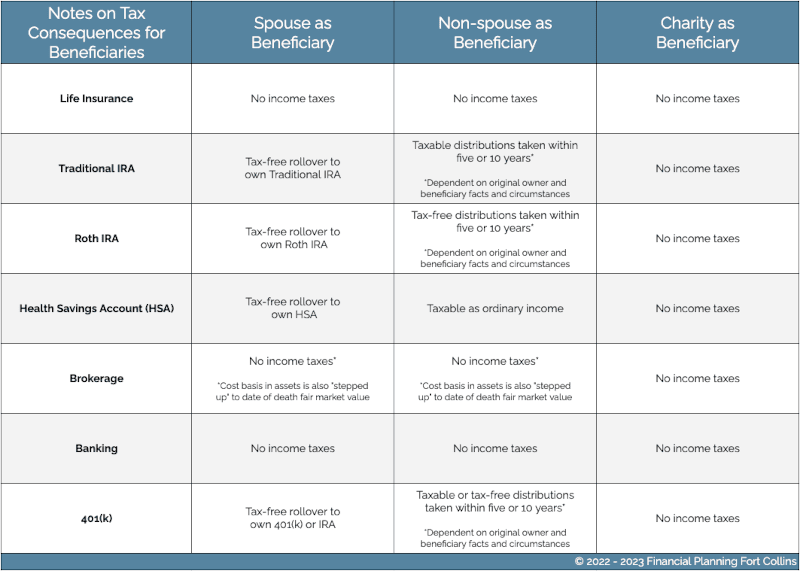

This chart provides high-level guidance on some of the potential tax implications of beneficiary designations. It’s important to craft your estate plan with a professional to understand the circumstances of your situation. There are a lot of nuances in this area.

Estate Planning Guidance

Estate Planning Guidance

A helpful exercise we do with clients is to create an anticipated flow of assets in the case of their passing. We typically identify whether their intentions are reflected in our hypothetical scenario. If not, this can motivate them to update their estate plans and/or their beneficiary designations.

As part of your experience as a comprehensive services client, you are eligible for our implementation policy. This is a credit of up to $300 that you can receive annually to implement parts of your financial plan, including obtaining an estate plan.

We are not estate planning attorneys, but we can guide you through a process under the supervision of estate planning attorneys to create your necessary documents. These can include:

Last will and testament

General power of attorney

Healthcare power of attorney

Living will

Advance directives

Living Trust

For more complex cases as well as those who prefer to work one-on-one with an attorney, we will be happy to provide references to professionals.

Regardless, I encourage you to schedule your Estate Planning Consultation. We’ll use our time together to help you better understand the mechanics of your estate plan and to review whether your intentions are reflected within your documents and your beneficiary designations.