Financially preparing for a baby can be daunting. Your household is already preparing for a new dynamic, and you may feel like your life is heading into an unknown new chapter. It’s an exciting, nerve-wracking, and joyful time.

The to-do list of prenatal care, baby shower planning, home configuration, and new shopping lists make this learning curve an intense one. And you suddenly realize that you’re about to welcome a child into your family, which inspires you to own the title as a “responsible adult.”

Holy smokes! You need to adult now and get your $#!+ together to financially prepare for this little one. Well, here are some lessons I’ve learned through my own experience as well as helping multiple clients through similar transitions.

Now, let’s find some ways to keep more money in your family’s financial net worth versus mindlessly adding to the billion-dollar baby-care industry.

Health Insurance: Planning for Your Maximum Exposure

Choosing a health insurance plan is complicated, and other factors come into play. The decision involves preferred providers, health savings account employer contributions, health insurance premiums, and more. But planning ahead for your financial year can decrease the overall expenses you end up paying toward health care. … So you can purchase more burp clothes (it seems you never can have enough).

Luckily, many health insurance carriers understand that proactive prenatal care can improve the health outcomes for mom and the child. This means that many services are coded as preventive, thus minimizing your costs — and your insurer’s. Everything else — like the hospital stay, labs, ultrasounds, and all other pregnancy (and non-pregnancy) related health care expenses — goes toward your deductible.

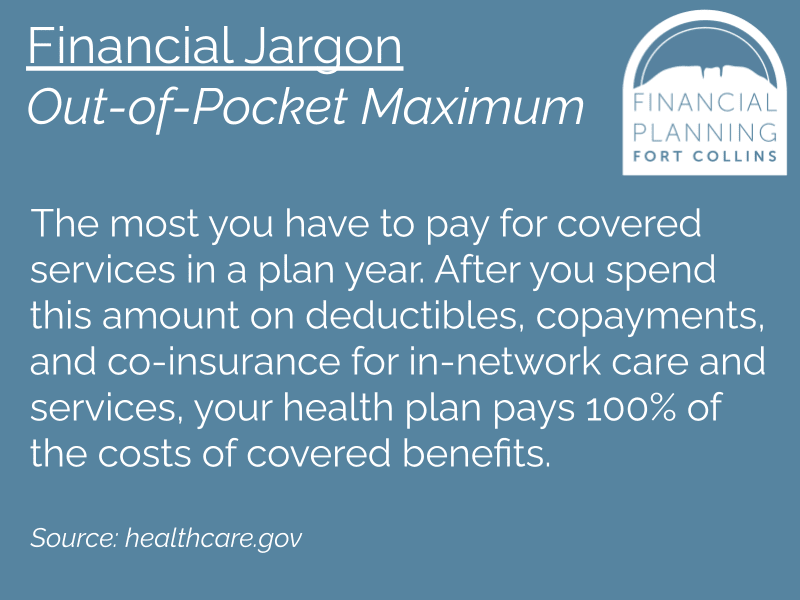

“Deductible” is one word necessary to understand when it comes to health insurance planning. And it’s best to analyze during years when you don’t plan for many medical expenses. However, for years that you do plan for medical expenses (like when having a baby), there’s another important term to plan around: your Out-Of-Pocket Maximum.

This amount is especially important for those with recurring medical expenses and for those who anticipate a large-expense year. For example, when looking at one example of a client’s health insurance options through their employer, one insurance policy has an $8,500 out-of-pocket maximum, while another has a $14,250 maximum. Having a baby is expensive, and there’s a tremendous amount of risk due to the potential complications for mother and baby.

Financial Tip: For risk management purposes and to forecast your upcoming budget, I recommend doing this exercise during the open enrollment period prior to when you anticipate having a child. We have guided some clients toward saving thousands of dollars when choosing between health insurance plans in the years they’ve planned for children.

- Calculate the annual health care premiums for all of the health insurance options available to your household.

- Add the annual out-of-pocket maximum to the premium cost for each of those health insurance plans.

- You’ve now identified:

- Lowest Exposure = Just premiums

- This is the lowest amount you can anticipate paying for the years in which you don’t foresee needing any covered health care services.

- Maximum Exposure = Premiums + Out-Of-Pocket Maximum

- This is the highest amount you can anticipate paying for covered services in a calendar year.

- Lowest Exposure = Just premiums

- Choose the risk-management strategy and health insurance plan that meets your provider preference, needs, budget, and other goals.

Income-Replacement: Short-Term Disability

For new mothers preparing for childbirth, your employee benefits may provide an insurance policy to help supplement your income while you’re either preparing to meet your child or caring for your newborn while also recovering. You likely heard of an insurance carrier that specializes in this type of insurance with their talking duck commercials!

The Family Medical Leave Act (FMLA) protects eligible employees from job loss — but not income loss — during parental leave. That’s when short-term disability insurance can prove valuable. Valuable as in, for six to eight weeks, you may receive 50-70% of your income after you give birth, depending on the type of delivery and doctor’s orders.

A new mother who experiences complications may have a longer recovery, so it’s important to also look into long-term disability insurance programs. In certain circumstances, this policy will kick in after the benefit period of a short-term disability policy.

Financial Tip: Some companies provide robust employee benefits with generous maternity and paternity leave packages (and some even include pawternity leave benefits for newly adopted pets). It’s best to collaborate with your human resources team in terms of your available benefits and anticipation of your expected leave. Also, ask some of your colleagues who have navigated similar situations so you can learn from their experiences. The year prior to when you expect to plan for a child, be sure to analyze your company’s benefits during open enrollment.

Buy Less Stuff: Buying vs. Registry vs. Secondhand

Enough with the risk-management and financial tips, right? I’ll gladly transition to a more fun new-parenting topic: cute baby stuff!

Before you meet your new family member, a brand new shopping list is thrust upon you. Baby monitor, bottles, swaddles, butt cream spatula, strollers, and burp clothes. Now, here’s an easy way to separate your new baby supplies into three financial categories:

Buying new supplies yourself

Registry for others’ generosity

Spending less money by finding supplies secondhand

Buying: Consider lower-cost items that promote the intentional culture of your family. Or, depending on your personal preference, you may want to purchase items you personally feel comfortable using brand-new. For example:

Decor, like artwork for the nursery

Outfits for pictures

Child safety items

Items that can get “gross”

– Burp cloths

– Bottles

– Cloth diapers

– Potty training toilets

Registry: Those fortunate enough to have supportive family members and friends sometimes need to create wish-lists of items for people to be generous. You may want to earmark the larger items you want for your registry versus the smaller ones. Also, many online baby registries allow people to contribute smaller amounts toward larger gifts. And, if you’re truly stumped and just don’t want to add items for the sake of adding items, open a college savings account with a gift code for people to contribute to in lieu of physical gifts.

Here are some examples of high-cost items that new parents often need or that you may want to use to promote the intentional culture of your family.

Nursery furniture

Bedside crib

Car seat

Stroller

Hiking backpack

Secondhand: Everything else! Especially clothes that your child will grow out of at such a fast rate.

Financial Tip: Spend less money by purchasing less stuff! My wife is skilled at finding (and giving) clothes, toys, and other supplies within her Facebook groups that promote “mommy communities” and “buy-nothing communities.” These communities are all about sharing supplies to prevent waste and preventable spending. For those who use social media sites, try finding your local communities by asking around or searching online. This habit has saved us thousands of dollars while also keeping items out of landfills. And many of these items will go on to other families when we’re done with them!

I understand that there are many ways to grow a family and that each family’s journey is different. Yours may include adoption, surrogacy, infertility, unplanned pregnancy, previous loss, or another path. So if you want to discuss how your expanding-family goal influences your financial plan, schedule a meeting so we can dive into your unique situation.