When thinking about the long-term, you can carry that optimistic mindset into how you want the world to be throughout the 21st century — and then into the 22nd and 23rd centuries.

ESG Investing

One way to act upon this optimism is to invest your dollars in companies that promote optimal environmental, social, and governance (ESG) factors and outcomes. This is also known as Socially Responsible Investing (SRI) and impact investing.

Many different companies are offering investment products with their own proprietary ESG screening models. This means that some companies meet ESG standards and are included in portfolios. Other companies don’t and are eliminated from investment portfolios.

For example, “sin stocks” describe companies that profit from alcohol, tobacco, and firearms sales. It’s possible to eliminate these companies from an investment portfolio so investors feel better about how their money is impacting the world.

Instead of just eliminating “sin stocks” from a portfolio, ESG models go much further to invest in companies that will hopefully make the future better for their stakeholders, employees, communities, and the overall planet.

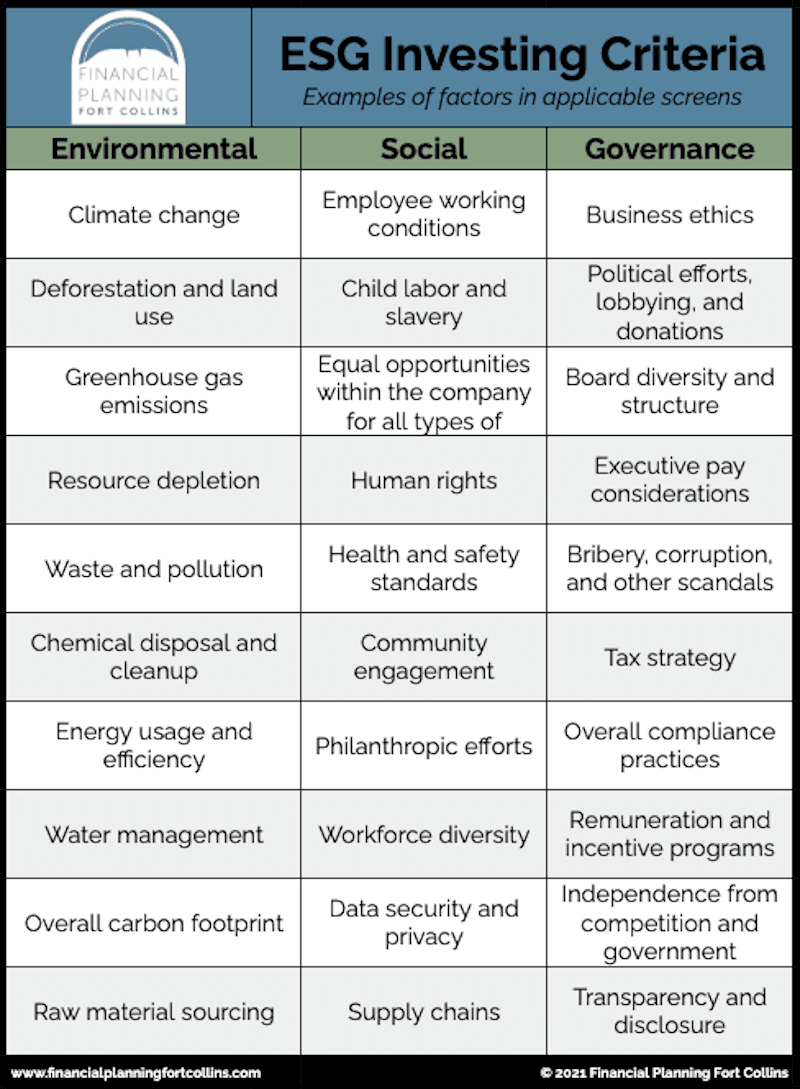

Here’s a chart that provides a breakdown of the many different factors that investment companies use when screening companies for these models.

The common arguments against ESG investing involve two main points:

1) You’re Sacrificing Returns: Incorrect

Markets have recently proven this point wrong, and this may be an indicator of how companies that meet ESG standards are overall better to invest in for the long run.

However, we don’t know if this is a trend, and we can’t forecast future results. Yet, positioning your dollars into ESG models can also have non-financial benefits, like knowing that your money is funding the world you want to see.

2) You’re Paying Higher Costs: Correct

To implement ESG screens and models, investment companies keep track of the stocks within their portfolios. Thus, they minimize the risk of including companies that do short-term work to get into ESG portfolios and then go back to nefarious practices.

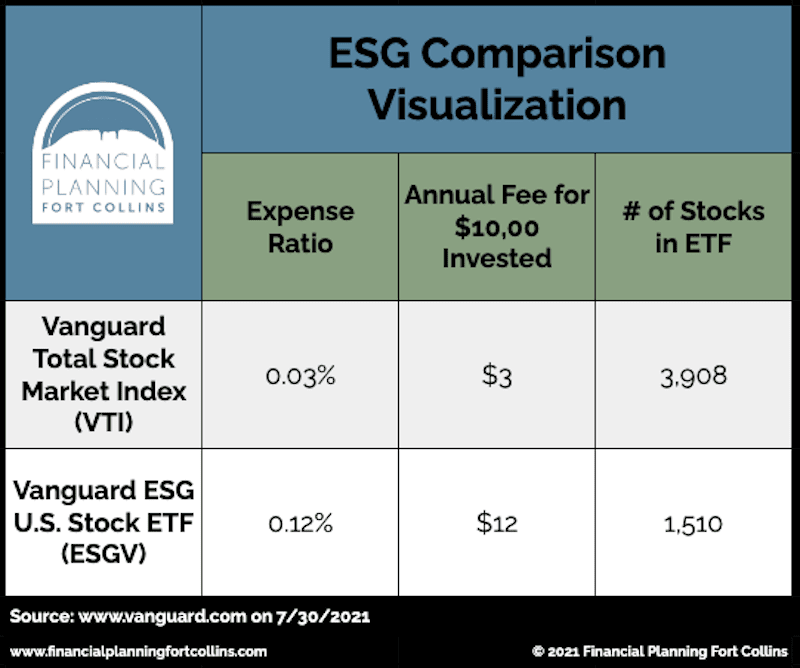

Luckily, the players entering the ESG investment landscape are increasing and causing fee compression. The costs of these investment products were much higher a decade ago when compared to the options available in 2021. Now, we can find ESG investment funds with only a few basis points more than a regular index fund.

For example, as of writing in late July 2021:

Going Further into Investing with Your Values

Some people want to go even further than the larger ESG-screened investment funds. When looking for impact investments, there’s a plethora of options and multiple screeners available.

For example, As You Sow has tools that grade how funds rank in specific categories.

It’s easy to get bogged down in the multiple options out there, so let’s simplify how you may want to invest with your values in three areas:

▶︎ Elimination investing

For those who want to avoid investing in specific industries, funds exist that specialize in these areas:

- Prison free

- Fossil fuel free

- Gun and weapon free

- Deforestation free

- Tobacco free

▶︎ Focused investing:

For those who want to specifically invest in companies and industries to make a difference in certain areas, there are options to find investments that focus on

- Gender equality

- Shareholder advocacy

- Clean energy

- Women in leadership roles

- Minority empowerment

▶︎ Alternate impact investing

Not all investments exist in your brokerage and retirement accounts. You can find opportunities in your personal and professional networks — or the many other investment opportunities out there that may not be as easy to find but can still make a difference.

Some examples include:

- Local companies with investment opportunities

- Specific projects in your community

- Other forms of angel investing

ESG Overview

CNBC released this comprehensive segment on the rise of ESG investing for those who wish to learn more.

All investing involves risk of loss. Please consult your financial and/or tax advisor and read any applicable offering documents and/or prospectuses before investing or sending money.

If you’re wondering how you can get started with ESG investing, head to our Meeting page and schedule some time to get together. We’ll spend some time discussing what’s most important to you and how you want your investments to make a positive impact on the world. Then, we’ll implement your strategy in the way that makes the most sense for your wishes and your portfolio.

This article is a preview of the FPFoCo Academy module “Making a Difference with Your Savings and Spending.” Head to the FPFoCo Academy to log in and experience the full module!