Have you heard? The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 has gotten an update! If you missed it, we can’t blame you. President Biden signed it into law on Dec. 29, 2022, and you might’ve been busy cleaning up your holiday decor, getting ready to wrap up work for the year … or waiting for your flight.

The headlines coming out of the SECURE 2.0 Act of 2022 were wide-reaching and ranged from 401(k) auto-enrollments and a boost to catch-up retirement plan contributions to required minimum distribution (RMD) changes and automatic retirement plan enrollment. With 92 new provisions, we’ll walk you through some parts of the bill that are most likely to impact you and your financial independence.

Retirees: RMDs and QCDs

From Director of Investment and Tax Planning Jason Speciner

Required Minimum Distributions (RMDs)

The original SECURE Act made some of the most significant changes to retirement plan accounts and IRA distribution rules in years. Much of the focus of the original SECURE Act was concentrated on distributions from inherited retirement plans and IRA accounts. However, the Act also included a provision that increased the required beginning date for required minimum distributions (together “RMD age”) from April 1 of the year after the taxpayer turned age 70.5 to the same date after the taxpayer turned 72.

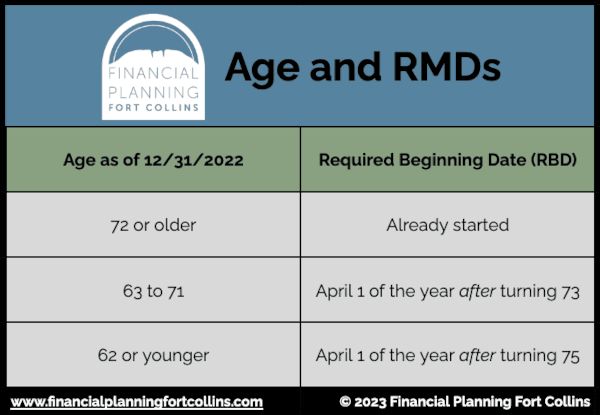

The SECURE 2.0 Act increases the RMD age again from age 72 to age 73, beginning with the 2023 tax year. SECURE 2.0 also future-proofs RMD age increases by increasing the RMD age again in 2033 to age 75. These changes are an immediate boon to anyone age 71 or younger on December 31, 2022, as expected tax costs for retirement plans and IRAs will be lower, all else being equal. Those age 62 or younger at the end of 2022 will have an even lower lifetime tax cost. This is because the ability to delay distributions means additional tax years where money in the account grows tax deferred and is not subject to current taxation.

Qualified charitable distributions (QCDs)

QCDs are a wonderful tax planning strategy, especially for taxpayers taking the standard deduction on their tax returns. When a QCD is taken after RMD age, the QCD will satisfy all or part of the RMD, up to $100,000. As a part of the SECURE 2.0 Act, the $100,000 annual QCD limitation will be indexed to inflation, beginning in 2024.

With the original SECURE Act, an interesting window opened between RMD age and the age at which a person could make a QCD (or the “QCD age”) from an IRA. Before 2020, RMD age and QCD age were the same: 70.5. The original SECURE Act changed the RMD age to 72 but left the QCD age at 70.5. This window allowed taxpayers the ability to take tax-free charitable distributions of up to $100,000 per year from an IRA for up to three years, without requiring any other sort of distribution. These tax-free distributions lower the balance of the IRA and, consequently, the RMD amount in future years.

With the SECURE 2.0 Act, utilizing QCDs beginning at age 70.5 remains a very effective strategy for lowering a lifetime tax bill. In fact, the window between the QCD age and RMD age is larger with an increased RMD age of 73. And it will grow in the future as the RMD age increases to 75 in 2033.

The Act also introduced the ability to make a one-time election to complete a $50,000 QCD to what is known as a “split-interest entity.” A split-interest entity is a trust or similar vehicle established for the benefit of both a charity and non-charity, typically the taxpayer or a member of the taxpayer’s family. In this case, the specific types of eligible split-interest entities would pay an income benefit to the non-charity beneficiary (specifically the taxpayer or spouse) for a number of years with the remainder going to the charity.

Because these split-interest entities can be expensive to establish and maintain, it’s unlikely that it would be cost-effective to establish one simply to receive a single $50,000 contribution (or possibly $100,000 total from both spouses). However, with necessity being the mother of invention, it will be interesting to see if streamlined and cost-effective mechanisms for taking advantage of this provision emerge.

RMD Penalties

If all of this alphabet soup has you spinning, you’re not alone. In fact, it’s not all that unusual for someone to miss an RMD, which has historically been a costly mistake. Missed RMDs used to be subject to a 50%(!) excise tax on the amount of the missed RMD. Yes, that’s half of what the RMD should have been!

With the enactment of the SECURE 2.0 Act, the excise tax is reduced to 25%. This is, of course, still costly. But it can be reduced even further, to 10%, if the RMD-misser takes corrective action within a specified period of time. While this period of time can vary based on IRS enforcement actions, it generally begins on the date the excise tax is imposed (i.e., 12/31 of the tax year in which the RMD was missed) and ends on 12/31 of the second year after the missed RMD.

In short: taxpayers have two years to self-report missed RMDs and correct the error for a substantially lower penalty.

Retirement Savings Plans

From Director of Estate and Financial Planning Dan Andrews

The federal government wants people to save more for retirement. So much so that many of the provisions of this new bill enhance the area where many Americans save: their employer-sponsored retirement savings plans, like 401(k)s.

Tax Credits for Employers: The federal government is giving eligible small-business employers incentives for start-up costs. They’ll also receive up to $1,000 per employee to offset the costs and the employer-based contributions associated with retirement plans.

Automatic Enrollments: The SECURE 2.0 Act expands provisions that encourage employers to automatically enroll employees into newly offered retirement plans after 2024. Employees can opt out, but employers can incentivize them to participate with low-dollar gift cards.

Automatic Increases to Savings Rates: Unless employees opt out, they’ll be automatically enrolled at a savings rate in-between 3% and 10% of their pay. The rate will automatically increase annually by 1% to 10%, and the automatic increases will stop when the contribution reaches 15%.

Portability: Employees with employer-sponsored retirement accounts containing less than $7,000 can automatically transfer their funds into new employer-sponsored retirement accounts when they change jobs. Consolidating retirement accounts just got easier, and the risk of having scattered employer-sponsored retirement accounts will dramatically decrease with this new provision.

“Lost and Found” Database: Another benefit is that this law will also create a searchable database housed at the Department of Labor to prevent losing forgotten retirement accounts. This database will be similar to the escheat systems states currently operate.

A friendly reminder to see if you have any “lost” money out there: Unclaimed Money.

Increased Catch-Up Provisions: As people near the retirement finish line, many get extra motivated to save even more. For those over the age of 50, the amount of extra money that they could contribute used to be a fixed amount (e.g., an additional $1,000 annually). Now that number will increase along with inflation.

People Between 60-63: To piggyback off of the last update about catch-up provisions, people age 60-63 can contribute an extra $10,000 or 50% of their income (whichever is greater) to accommodate their savings motivation. This provision doesn’t start until 2025.

Expanded Roth Features

1. SEP and SIMPLE IRAs can now have Roth features. Before, only pre-tax contributions were allowed.

2. Employer contributions can now be directed to the Roth portion of employee retirement accounts. The employees will recognize that money as income.

3. Catch-up contributions for those making more than $145,000 a year need to be Roth contributions.

SECURE Accumulation

From Director of Cash-Flow and Insurance Planning Regina Neenan

Working to grow your net worth? The SECURE 2.0 Act includes some perks that might apply to you, like a new emergency savings account, student loan payment matching in your retirement account, and 529 Plan rollovers to Roth IRAs.

Emergency Savings

Does your employer offer a retirement account, like a 401(k) or 403(b), to which you’re eligible to contribute? If so, you may soon have an emergency savings account linked to it! Bonus: Your employer can contribute, too.

Starting in 2024, employers who offer retirement plans will also offer linked emergency savings accounts and will auto-enroll their employees in participating. Here’s how it works: If you don’t opt out, you’re enrolled to contribute 3% of your compensation to the account. These dollars go in after-tax, and your employer can add a matching contribution. The dollars your employer adds are taxed just like regular income. Have an emergency and need to take a withdrawal? If your withdrawal qualifies, you take your dollars out tax- and penalty-free.

These emergency savings accounts will be similar to your regular high-yield savings account … with less access to your money. Employers must keep your funds invested in cash and cash equivalents so that your dollars are available in the event of an emergency. That’s right: This account is true to its name. Created to help folks cover pure emergencies, taxes and penalties can apply for non-qualified uses.

Other caveats include an income limit, potential fees on withdrawals, and a contribution limit. If you make more than $135,000, you can’t participate. While eligible participants are allowed one distribution per month at minimum, their savings plans can charge fees if they take more than four per year. And once your balance reaches $2,500, you’re no longer eligible to contribute to it from your paychecks, although you can still earn interest.

Sure, this Roth-like account might not allow you to save enough to cover your total emergency fund goal. But it’s meant to help people who have trouble saving in the traditional way. It helps those who would otherwise not be able to cover an expensive emergency or who would go into debt to cover one financially. Still, I’m willing to bet that it’s the only non-retirement-focused savings account to which your employer might add matching contributions!

Just don’t get too excited about those extra dollars going in quite yet. Remember that using this account requires a qualified emergency. So you couldn’t distribute from it for opportunities, like buying tickets to a concert, without paying taxes and penalties. All the more reason to maintain a strong emergency and future opportunities fund (EFOF).

Student Loan Payments

Got student loans? While many of us are waiting to see if that $10,000 forgiveness will ever happen, there’s other news in the student loan world. Like many other pieces of the SECURE 2.0 Act, this one starts in 2024, and it’s all about matching.

You make your student loan payment, and your employer will be albe to make a matching contribution to a retirement plan for you. You pay down your debt, and your retirement savings gets a boost.

It’s a nice option for folks with student loans who often have to make the difficult decision of whether to save for their futures or pay down their current debt.

529 Plans

Another key aspect of the SECURE 2.0 Act is the ability to roll 529 Plan funds directly into Roth IRAs. Like the other noteworthy changes for those in the accumulation phase of their lives, there are a few catches.

The first is that the 529 Plan has to have been open for at least 15 years. Fifteen! On top of that, contributions made to the Plan within the five years before the direct transfer aren’t eligible for transfer.

In addition, the 529 Plan beneficiary must have compensation, annual direct transfers are limited to that year’s IRA maximum, and the cap on lifetime transfers from 529 Plans to Roth IRAs is $35,000. While this isn’t a massive amount, it could certainly be beneficial. Consider, for example, what it could mean for a recent college graduate who received a scholarship and didn’t use all of their 529 Plan funds. Over the course of a few years, they could roll over up to $35,000 and give their Roth IRA a healthy start early in their working years.

What parts of the SECURE 2.0 Act are you most looking forward to? Which areas do you have questions about? If you’d like to take a deeper dive into any of the provisions we mentioned above — or some of the other 92 changes this Act brings — feel free to reach out. You can always find a convenient time to get together.