Pop quiz: How much could you save for your comfortable future this year?

No, it’s not a trick question! While contribution limits for some savings vehicles increased for 2020 — I’m talking about you, health savings accounts and 401(k)s! — others are staying the same. No matter your goals, maximizing your retirement savings this year starts with knowing what you have to work with as well as the new contribution maximums and what’s staying the same.

Maybe you want to make the most of what you can already invest. Perhaps your budget allows you to contribute more this year. But with so many ways to save for financial independence, what’s the most strategic way?

As with most things financial planning, that’s a loaded question with many different answers. The way in which you locate and allocate your future finances depends on many factors in your unique situation.

Choose your own contribution

Remember those Choose Your Own Adventure books from back in the day? Or maybe you’re more of a “Black Mirror: Bandersnatch” fan. Either way, you decide where the story goes. In that spirit, you can use this guide to make the most of your retirement contributions this year. It can also be helpful as you establish a framework for how you may want to contribute in the future. Simply follow along, consult your financial professional before implementing any changes into your financial plan, and choose your own retirement plan contribution.

Making an informed decision

Like the protagonists in choose-your-own-ending media, you have a backstory. Before going off on your contribution adventure, take a step back and look at where you’ve been. Just because you have retirement investments today doesn’t mean you should continue to contribute as you have in the past. As Albert Einstein said, “Insanity is doing the same thing over and over again and expecting a different result.” So if you want to make the most of your retirement savings, it might be time to take a fresh look at your financial future.

Just a few retirement contribution considerations include:

- Amount of debt you owe

- Whether or not you’ve established an emergency fund

- Plan options you have access to

- Contribution maximums

- Taxes or penalties — or both — for early withdrawal

- Age-based catch-up contributions

- Risk and reward potential

- Amount you already have saved

- Savings goals

- Tax bracket

- Cost of living, budget, and discretionary spending

- How long you have until retirement

- Other financial planning techniques you employ

- And so, so many more

Overwhelming, right? Let me make it easy.

Retirement plan contribution basics

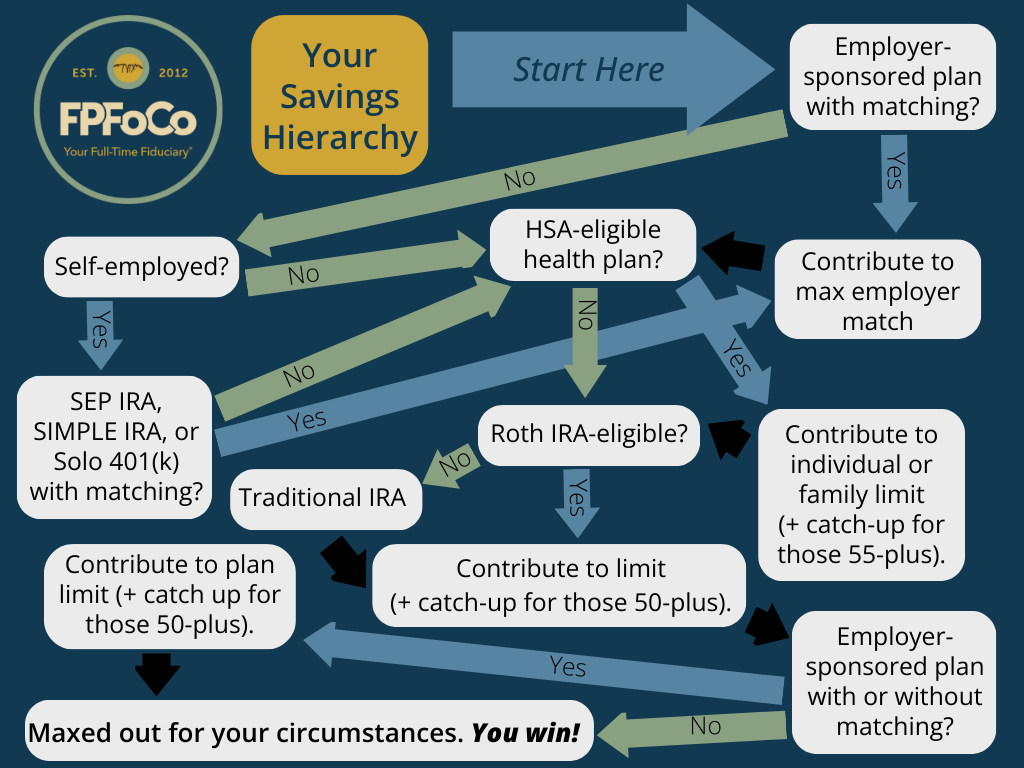

Here’s a super-simplified version of plan contribution options. Folks who have access to employer-sponsored retirement plans with employer matching, HSA-eligible high-deductible health care plans, and Roth IRAs can follow the mini-guide in this order of generally recommended contributions, complete with new-for-2020 limits:

- Employer-sponsored plan; up to employer match — check with employer for match terms

- HSA; $3,550 individual coverage or $7,100 family coverage — plus $1,000 more for each covered spouse age 55-plus

- Roth IRA; $6,000 — $1,000 more for those age 50-plus

- Above employer match up to max; check with employer for contribution limit — plus catch-up options for those 50-plus

A little more adventure

So what about those without employer-matching plans, HSAs, or Roth IRAs? Many working and earning people can open and contribute to their own Roth IRAs. However, other retirement saving options can be a little trickier, depending on your circumstances. That’s where the real adventures begin. You can follow the infographic as you consider your contribution options:

Which steps did you take, and where did you end up? It should give you an idea of your contribution options. And if you’re wondering about the method behind the mindmap madness or why you landed where you did, let me break it down in a couple examples.

Examples

Here’s what you might want to do if you …

… are employed but receive no employer match. Without an incentive to contribute to an employer-sponsored plan, investing in your health savings account (HSA) then your Roth IRA might be your best bet for making the most of your tax-advantaged savings. No HSA? After-tax, non-tax-deductible contributions to your Roth IRA — with tax-free growth — could still be a strong option. If you’re not eligible to contribute to a Roth IRA, a traditional IRA comes in as a strong next choice and may even make more sense if you’re in this exact situation.

… are self-employed but have no “company” retirement fund set up yet. Why not invest in yourself and your future via business retirement savings? You may have many options — including a SEP IRA, SIMPLE IRA, or Solo 401(k) — depending on your situation. If you’re not ready to take the leap, you may want to start by investing in your HSA followed by your Roth or traditional IRA.

… don’t have a high-deductible health insurance plan. Without an HSA-eligible plan, you may begin by contributing to your employer plan up to your employer’s match — to get that “free” money. Then you could switch gears to your Roth IRA and finish up your 2020 retirement contributions by adding to your employer plan up to the maximum to top-off your tax-advantaged savings.

Of course, your long-term savings is only one part of your financial life, and any changes here could have wide-reaching effects on other areas. And I might sound like a broken record, but I’ll say it again: It’s always a good idea to work with your financial professional before making any major changes. Not only can a pro help you understand how changes could affect your future financial freedom but he or she can also assist you in choosing the best path forward based on your unique circumstances.