Maybe you decide you’ll invest your extra moola. But how?

Think of this analogy:

Base Jumping Approach : Individual Investments

Thrill Ride Approach : Diversified Portfolio

Some people may take this extra money and invest it in the latest trend, thus putting all their eggs in one basket. This leap of faith can end in a home run — which the person will brag about for decades — or a facepalm. This is the Base Jumping Approach to investments. It often provides a nerve-wracking experience, which can be exciting yet financially disastrous.

▶︎ A potential phrase here is “Well … that didn’t work.”

Then there’s the Thrill Ride Approach. This investing experience might not be as exhilarating as Base Jumping but can still provide some ups, downs, twists, and turns. You spread the money around in multiple investments, which minimizes your risk of putting all your money into one category. This approach may provide some guardrails, or a lap bar, to hopefully prevent you from financial disaster.

Where To Park Your Money?

Many people don’t know what to do with their surplus cash, so they harbor the funds in the easiest option: a checking or savings account. Yet cash is designed to be worth less next year with inflation. Just think about how much a dollar could buy 10, 20, or 30 years ago compared to how far that same dollar would go today.

This may motivate you to park your money in an investment that may earn more than inflation over time. But there are pros and cons with every investment decision, and the choices may intimidate you.

Many options exist. Plus, you have options within options, which can be overwhelming. Here are some examples of where you could stash your money:

-

- Stocks

- Bonds

- Money Market Funds

- Treasury Bills

- Checking Accounts

- High-Yield Savings Accounts

- Retirement Accounts

- Certificates of Deposit

- Annuities and Insurance Products

- Real Estate

- Private Businesses

- Trust Accounts

- College Savings Plans

- Cryptocurrency

- Precious Metals and Commodities

- Charitable Giving Accounts

- Artwork and Collectibles

- Cash Under the Mattress

These options can freeze people and stop them from making decisions. Rational economists explain that people want more choices so they have more freedom to make decisions best suited for their unique needs. Yet some economists understand that people can also behave irrationally.

Economists have argued that people are happier when they choose among fewer options.

Think of an ice cream store with chocolate, vanilla, and strawberry. You make your choice and move on. Yet when you have 31 choices, you can be influenced by “decision paralysis.” This means that people freeze because they have too many options and they don’t want to make the wrong decision. And even after the person makes a choice, they can still be unhappy due to worrying about having made the wrong decision.

Investment Choices

From the TEDBlog article titled Does having choice make us happy? 6 studies that suggest it doesn’t always:

‘In his blockbuster TEDTalk “Barry Schwartz on the paradox of choice,” the Swarthmore College professor quotes a study conducted by Iyengar and Emir Kamenica. The pair looked at the retirement savings choices made by half a million employees through the Vanguard Group. Analyzing the data, the pair found that for every 10 additional funds offered to an employee, the chances that an employee would invest in none of the above increased by 2.87%. Schwartz explained the significance in his talk. “With 50 funds to choose from, it’s so damn hard to decide which fund to choose that you’ll just put it off until tomorrow. And then tomorrow, and then tomorrow,” he said. “By not participating, they are passing up as much as $5,000 a year from the employer.”’

Now take this same mindset when addressing the options for stocks and bonds. You can see this fascinating map from the World Bank Group showing that there were more than 32,000 publicly listed companies in the world in 2019. A question for you: How are you supposed to analyze over 32,000 companies to see which stocks you should buy for your own investment account?

Two words: index funds.

Instead of picking individual stocks (Base Jumping Approach) and worrying about making the right choices, you can invest in index funds (Thrill Ride Approach), which are comprised of multiple companies represented in a certain category.

▶︎ Think of the S&P 500 index. Instead of worrying about which stocks to invest in, you can purchase an index fund that follows the overall S&P 500 index. Voila! You’re now invested in around 500 companies with a single purchase.

The investment strategies you discuss with your financial planner before opening your accounts may embrace this Thrill Ride philosophy. If you work with your advisor to invest in index funds, your account would hold multiple funds that follow indexes across multiple asset classes like U.S. stocks, U.S. bonds, international stocks, international bonds, and others.

Different Results from Different Asset Classes

A benefit to having your money spread out through multiple areas is that if one sector decreases in value, then the other sectors may minimize your potential losses.

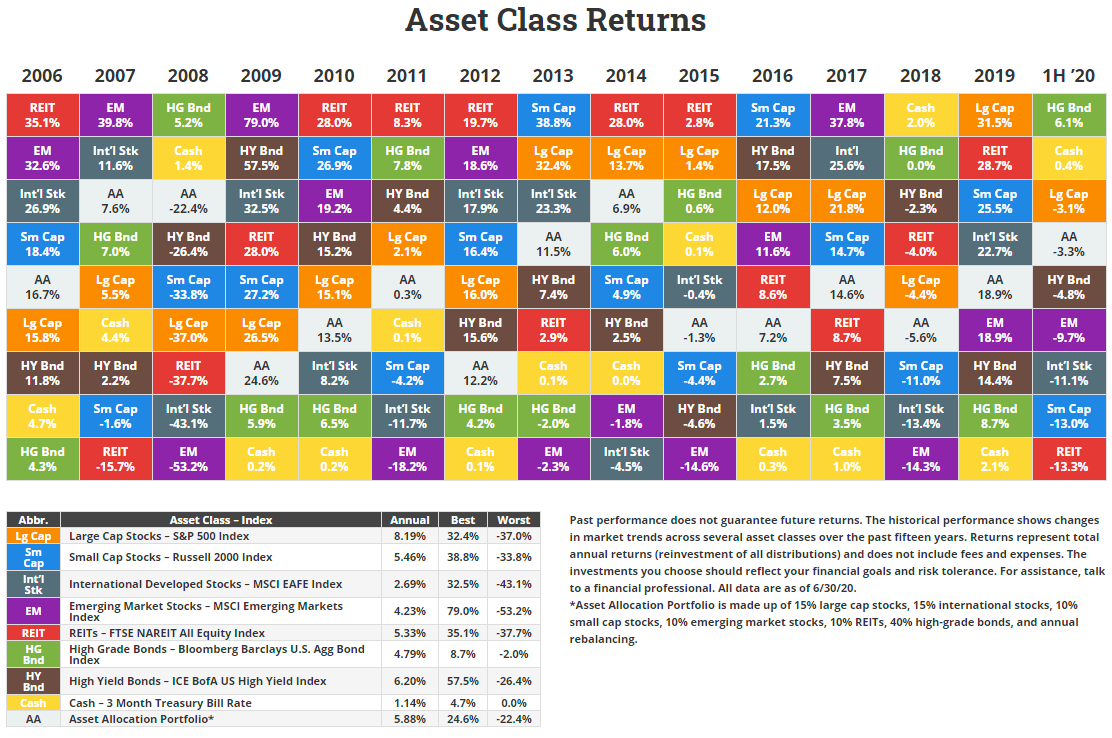

For example, in 2019, large-cap stocks were the top performer, up 31.5%. Cash was the bottom performer but still earned 2.1%. And a diversified portfolio including those same eight sectors was up 18.9%.

Compare that to the first half of 2020. In this unprecedented year, like in 2008 when high-grade bonds topped the chart and earned 5.2%, they’re again among the top performers, up 6.1%. Similarly, cash is taking the number-two spot so far this year, being the only asset class other than bonds that’s positive, up 0.4%. Still, the diversified portfolio this year is around the middle of the pack as far as returns go, seeing portfolios down just 3.3%.

Source: NovelInvestor.com

Source: NovelInvestor.com

These quilted charts are some of my favorite education tools. Draw your attention to the white box throughout the quilted chart. This represents a diversified portfolio (Thrill Ride) consisting of multiple asset classes. Notice how this diversified portfolio remains near the middle of the pack. It’s not immune to losses, but it provides a less-volatile journey. If you want to see a volatile journey, follow Emerging Markets marked in purple.

Going back to choices, instead of putting so much pressure on which asset class to choose, you could invest in them all with low-cost index funds.

The Opposite of Diversifying

You might have heard some horror stories of people who put all their eggs in one basket — and then lost big.

“Just remember the teary-eyed Enron employees who held nothing but Enron stock in their retirement plans. When Enron went under, they lost not only their jobs but all their retirement savings as well. Whatever the investment objectives, the investor who is wise diversifies.”

Burton G. Malkiel

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing

It’s my philosophy in life and in investments to spread risk into multiple areas. Just like we saw in the Asset Class quilted chart, you likely won’t be at the peak, but you probably also won’t wind up at the bottom.

A gentler thrill ride is fine by me. Let’s leave the base jumping to the adrenaline junkies!

Photo by Jason Chen on Unsplash