“Why do I have all of these accounts again?”

Can you relate? You may reach this epiphany when you gather your tax documents, receive email notifications about your accounts from multiple financial institutions, or reach your limit on how scattered your financial life feels.

You’re not alone. We see many client cases where people have duplicate accounts with themes like:

You have old company retirement accounts that you never rolled over and they’re still parked at a random company.

Your first-ever bank account that you opened when you were 11 is still open and you rarely use it.

There’s an investment account in your name with a random stock position that a grandparent gifted you.

You opened a random credit card during college to receive a free t-shirt (it’s an XXL … and you wear a medium — that story’s personal).

Instead of allowing your financial life to remain unnecessarily complicated and scattered, let’s discuss how you can organize your financial life!

Getting Your Financial House in Order

The first step in regaining control of your finances is doing an inventory of your current circumstances. This means gathering all the most recent information, account statements, and other pertinent details (employee benefit options, equity compensation grant documents, etc.).

List out all of your accounts in a spreadsheet, link them into RightCapital (more on that tool later), or just start on the back of the napkin. This stage is all about taking inventory so you can then begin simplifying your financial life in the next steps.

Pro Tip: A good place to start when taking this inventory is your most recently filed tax return.

2nd Pro Tip: Unless you’re absolutely confident your information is secure, it’s best to leave account numbers and other sensitive information off of your inventory list. Please don’t write them on the back of the napkin and then misplace it.

Creating Intention Behind Your Accounts

Now that you know what you’re working with and where your accounts are located, let’s design some intentionality around your financial life. The question we should answer at this stage is, “What account is where — and why?”

To give you a basic framework on how and where to get your financial house in order, consider these strategies:

▶︎ A high-yield savings account (HYSA) for your emergency fund

Once you identify your emergency fund target (aka the amount of money you should have available in cash), consider opening a high-yield savings account so you can earn some interest on your savings.

Pro Tip: These HYSA interest rates are always changing because companies frequently offer new promotions to out-compete other financial institutions. Instead of chasing the latest HYSA interest rates — which are constantly changing — I recommend committing to an HYSA and then revisiting your strategy every two to three years. For many people, it’s not worthwhile to commit a large amount of mental energy and logistics to move your emergency fund from a 0.80% interest rate to a 0.85% interest rate. Rather, focus more time and energy on other areas of your life.

If you’re closing out an old bank account and moving your funds to your HYSA, it can be helpful to keep a cash cushion behind. This can come in handy if you had automatic payments coming out of your previous bank account — and help you avoid any post-bank-breakup overdraft fees. Once you’re sure that your last auto-draft has gone through and you’ve set up your payments with your new bank, it’s time to close out that old account for good.

▶︎ Investment accounts

For your investment accounts, things can get pretty complicated due to the multiple types of accounts out there (401(k), health savings accounts, brokerage, IRAs, etc.). In the theme of getting your financial house in order, let’s organize your accounts to align with your intentions so you can understand each account’s purpose as well as consider the tax implications.

Keep in mind that some custodians may deduct transfer fees and closing charges from your account balances. These tend to range from $25 to $125, and you can find what your custodian charges on their website or by phone (just hope there’s decent music to listen to if you end up on hold!). While they can be unpleasant, these charges and fees tend to be small prices to pay for the peace of mind that consolidation brings.

Nest Egg: Shorter-Term Goals

The structure of some investment accounts can help you understand what account you should have open and why. For example, a retirement account is great for tax-deferred growth over a longer period of time. But if you try to access that money before a certain age, you may have to pay taxes and penalties. This is why it’s good practice to have some of your nest egg and savings in a brokerage account if you anticipate needing the money throughout your life’s journey.

Nest Egg: Longer-Term Goals

As mentioned in the previous section, for longer-term savings that you want available as your nest egg in your longer-term future and retirement, take advantage of tax-deferred savings and avoid those early withdrawal penalties. Some accounts that come to mind for many people:

- Health savings accounts (HSAs)

- 401(k)s, 403(b)s, and other company retirement plans, and

- IRAs and Roth IRAs.

Investing as a Hobby

It’s no secret that investing can be entertaining. You see stock pundits blowing air horns and ringing bells on TV, internet communities boasting stock memes, and investing apps designing investment decisions like a video game. For example, one app has confetti bursting across your phone screen when you purchase a stock position.

To ensure that your nest egg is invested per your risk tolerance and time horizon, we generally recommend that people designate a separate brokerage account as their “hobby” account so they don’t jeopardize their nest egg when stock-picking. This creates an intentional guardrail to keep your “investing as a hobby money” separate from your life savings.

Facilitating Organization

During your inventory, you may identify duplicate accounts or even accounts that aren’t in your best interests anymore — for example, an old bank account that charges avoidable fees or even that college credit card with unfavorable terms. During this stage of getting your financial house in order, we recommend you implement your intentional system. Consolidate accounts, nickname accounts to spell out each one’s intention — e.g., labeling your emergency fund as “emergency fund” — and/or finding ways to enhance your accounts.

Once you begin simplifying your financial life, you may experience these added benefits:

You decrease the number of accounts open in your name, improving your ability to keep track of your accounts and hopefully become aware of identity theft risks early.

You receive fewer emails and less physical mail from multiple financial institutions.

You consolidate your money management and investment strategies to work in concert with your new system(s).

Come tax time, you decrease the amount of paperwork to gather, analyze, and submit by having fewer financial institutions involved.

You have the confidence that your finances are built to serve you instead of feeling that your financial system is just getting messier and messier as time goes on.

Modern Tools to Stay Organized

RightCapital — This is the data aggregator we use for your financial planning analysis. Many clients tell us that they appreciate the centralized location to visualize all of their financial accounts.

Everplans — This app acts like a “digital safety deposit box” where you can store sensitive information and copies of your statements. We’ll also reimburse you for your subscription.

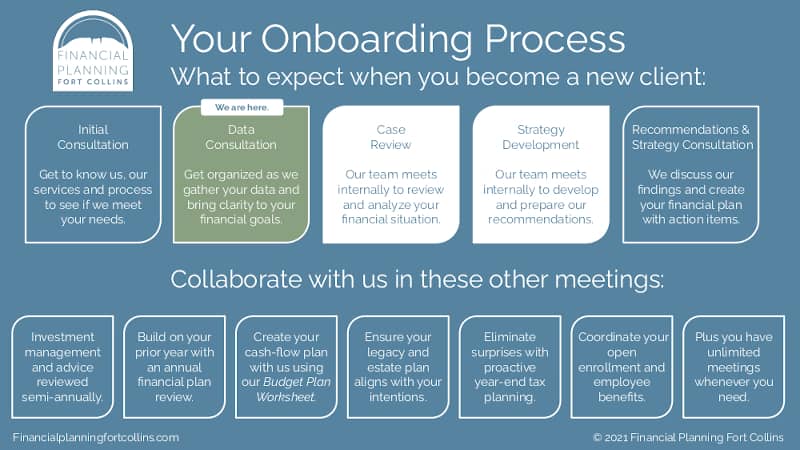

Financial Planning Fort Collins — Delegate keeping track of your financial information to our team! Don’t forget that the Financial Planning Fort Collins team is here to help you get — and stay — organized! As you remember in your onboarding process, your first few meetings focused on making sense of your information and then creating a financial plan.

As you can see, your client experience includes other reviews and check-ins plus unlimited meetings so we can all keep your financial planning to-dos as current as possible. This way, you can keep your financial house in order instead of letting your finances get unnecessarily complicated again.