Think of your life as an orchestra for a moment. When the experience is timed out, planned, and coordinated, beautiful music arises. When the orchestra members “wing it” without much preparation, a musical mess may grace your eardrums. And that could have been avoided with some proactive planning before the performance.

Well, keep reading to see how you can space out your proactive financial planning tasks through an easy-to-follow annual cadence. This allows you to address your tasks with rhythm — instead of as a reactive cacophony.

Financial Planning is a Proactive Process

Here’s where we — your financial planning team — grab an instrument and take a seat. There’s a lot in the realm of financial planning, and it’s common to feel overwhelmed. Just like someone studying music for the first time, the learning curve can feel intense when addressing an unknown subject or when you’re learning at a more advanced level. In addition to being an expert in your own life — personal and professional — how can you find the time to become an expert in so many other areas? These include …

- Cash-flow planning

- Tax planning

- Equity compensation planning

- Estate planning

- Insurance and risk management planning

- Open enrollment and employee benefits

- Retirement planning

- Education planning

- Healthcare and insurance planning

- Impact and charitable giving planning

- Investment planning

When we don’t properly coordinate and synchronize these subjects, preventable miscues become more common.

To help you avoid playing out of tune, our financial planning process can help you chip away at these multiple subjects.

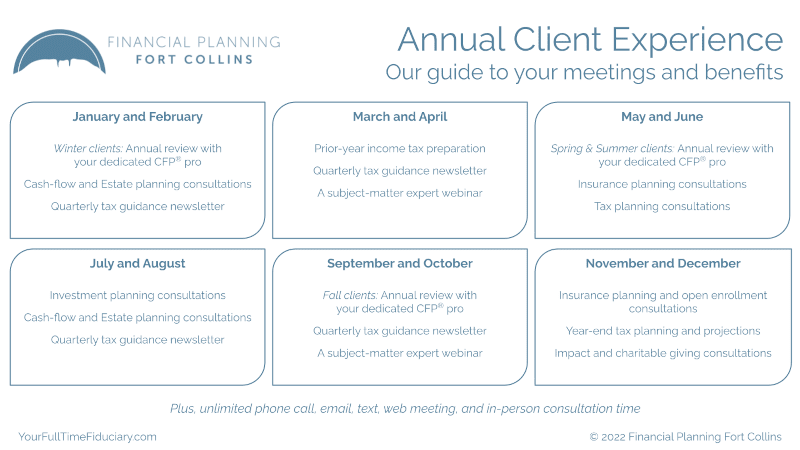

Your Financial Setlist

After your onboarding process or annual financial plan review, you’ll notice a rhythm to your client experience with Financial Planning Fort Collins. We schedule a “setlist” of meetings throughout the year so you can make progress on a variety of personal finance topics. As you conquer one, you’ll move to the next.

For example, after you establish the basics — like learning chopsticks on the piano — we’ll move onto more complicated financial strategies as we all work on your eventual financial masterpiece!

We find this spaced-out timing method to be less overwhelming and more motivating for you as our client. So what does this look like in practice, and what should you expect this year? Check out your annual calendar below!

Synchronizing Your Financial Plan

Synchronizing Your Financial Plan

As we do our part to keep your financial plan on track, we’ll monitor your progress. And we’ll proactively invite you to the meetings that we think you’ll find useful. While we might not reach out to you every month — we don’t want to overwhelm you with too-frequent or irrelevant meetings — you can expect regular communications from us.

It’s a team effort to synchronize your financial plan. We’ll take many things off your to-do list but will still ask you to implement parts of your financial plan. To stay on the musical theme, I’ll pivot to another style of music: classic 90s hip hop.

To give you some extra motivation to implement the strategies that we address in your annual client experience, we encourage you to sing a little tune whenever you feel discouraged or overwhelmed. Remember the tune from the classic 90s song “Shoop” by Salt n’ Pepa? The repetitive chorus goes:

🎼

Shoop shoop ba-doop

Shoop ba-doop

Shoop ba-doop ba-doop,

Ba-doop

🎼

Now, replace the lyrics with the below words to give yourself a little boost in financial planning motivation:

If you ask nicely during your client meeting, I’ll also perform this for you to help you stay motivated. Anything I can do to help! 🙂

And don’t forget about your unlimited meeting and consultation time! Head to the meeting page to schedule convenient get-togethers on the topics of your choice at your convenience.

Want to make sure you’ll receive the invites you want this year? You can always check in with us! Just send a quick note to to let us know which meetings you’re interested in having. We’ll cross-reference your meeting calendar and add the invites of your choosing. And while we might reach out with additional meeting invitations that we’ve identified, it’s ultimately up to you whether you schedule or not.

Your Next Musical Movement

As tax season builds to a crescendo, we encourage you to engage in the tax-prep process. If we can resend your invitation email or answer any tax-related questions, just let us know.

And be sure to stay tuned (pun intended) for these May meetings:

- Annual Financial Plan Reviews for Spring and Summer Clients

- Insurance Planning

- 2022 Tax Planning

If you’re interested in one or more of the above consultations, feel free to request a spot on our guest list. We’ll be sending invitations in mid-April, as tax season comes to a close.

We’ll look forward to meeting with you soon — and making your financial plan a hit!