New for 2022: The ability to save more in your tax-advantaged accounts!

While your IRA and Roth IRA maximums are still $6,000 this tax year — with the same $1,000 catch up for those 50 and older — you can stash a little more cash in some others. Read on to learn what’s changing and how you can set your contribution limits accordingly if you’d like to be on track to contribute the max you can add to your tax-advantaged accounts in 2022.

Employer Retirement Plan Contributions: To the Max!

Back in November of 2021, the Internal Revenue Service (IRS) announced some exciting changes to retirement plans. Sure, a couple of digits changing to increase retirement plan contribution maximums by $1,000 or so in most cases might not sound too thrilling at first blush. But taking (tax) advantage of higher contribution limits could mean getting a tax break now and paying less in taxes over the long run. Pretty exciting now, huh?

If you have access to an employer-sponsored retirement account, here are the changes you should know about.

401(k)s, 4013(b)s, 401(a)s, 457s, and Thrift Savings Plans (TSPs) Are Up

After a $500 increase from $19,000 in 2019 to $19,500 in 2020, maximum contributions for these plan types stayed stagnant in 2021. For 2022, however, they’re up by $1,000 for a current-year max of $20,500. And, while the age 50-plus catch-up contribution increased back in 2019 from $6,000 to $6,500 in 2020, it’s still there. That means, if you’ll be 50 or older at the end of 2022, your overall max contribution is $27,000 this year.

Ready to max? Here’s what your per-paycheck contribution should be for the most common pay schedules, depending on your age. Note: If you’ve already received a paycheck for this year or your HR department won’t be able to update your contribution during this pay period, you’ll need to adjust. Simply divide your contribution max — or your contribution goal for this year, if you’re not ready to max — by the number of paychecks you’ve got left in 2022.

Under 50

Biweekly pay with 26 paychecks per year: $788.47 per pay period

Semimonthly pay with 24 paychecks per year: $854.17 per pay period

Monthly pay with 12 paychecks per year: $1,708.34 per pay period

50 and Older

Biweekly pay with 26 paychecks per year: $1,038.47

Semimonthly pay with 24 paychecks per year: $1,125

Monthly pay with 12 paychecks per year: $2,250

You might notice that all but the last two of the above will exceed the maximum contribution for your age by less than a dollar. Most payroll tools will reduce the final salary deferral on the last paycheck of the year to meet the contribution maximum exactly. But it’s a good idea to check with your HR department to ensure theirs does so you don’t have to worry about removing excess contributions later.

SIMPLEs Are Also Up

Having increased by $500 from 2020 and 2021’s maximum of $13,500 to the new-for-2022 max of $14,000, you can add more to your employer’s SIMPLE IRA this year. Like the plan types discussed above, however, the catch-up contribution for those 50-plus remains at $3,000.

If you’re a participant in a SIMPLE IRA, here are your per-paycheck breakdowns.

Under 50

Biweekly pay with 26 paychecks per year: $538.47

Semimonthly pay with 24 paychecks per year: $583.34

Monthly pay with 12 paychecks per year: $1,166.67

50 and Older

Biweekly pay with 26 paychecks per year: $653.85

Semimonthly pay with 24 paychecks per year: $708.34

Monthly pay with 12 paychecks per year: $1,416.67

Did you skip down to this section and realize that these contribution levels would add a few too many pennies to your total contribution for the year? Your HR department’s payroll tools will probably reduce your final contribution of the year by that same amount to hit your max without going over. But you should confirm this with them to avoid overcontributing.

New IRA Phaseout Ranges

Are you or is your spouse a participant in your employer’s retirement plan and one of you also contributes to your traditional IRA? Again, IRA contribution maximums are staying the same this year. But if you or your spouse is a high earner, you might have been “phased out” from being able to deduct the pretax dollars you contributed to your traditional IRA contribution from your taxable income in the past.

And if you contribute to your Roth IRA, you might have had to take the backdoor route before. That’s because there’s a phaseout for being able to contribute directly to a Roth IRA.

On the bright side, phaseouts for both traditional and Roth IRAs are higher for 2022. Here are the taxable income ranges you need to know, which depend on your taxable income and tax filing status.

2022 Roth IRA Phaseout Ranges

Single and Head of Household: $129,000 to $144,000

Married Filing Jointly: $204,000 to $214,000

Married Filing Separately: $0 to $10,000

If your taxable income is lower than or equal to the low end of each range, you can contribute the maximum of $6,000 directly to your Roth IRA. And if you’re 50 or better, you can up that contribution by $1,000. If you’re above the range, it’s the backdoor for you if you want to contribute. If you fall within the range, you can contribute a portion of the max directly to your Roth IRA, depending on your taxable income, but you’d have to contribute the other portion via the backdoor if you’re looking to maximize.

2022 Traditional IRA Phaseout Ranges

Single and participating in your employer’s plan: $68,000 to $78,000

Married Filing Jointly, where you’re the spouse covered by your employer’s plan and you’re contributing to your traditional IRA: $109,000 to $129,000

Married Filing Jointly, where you’re the spouse not covered by an employer plan but your spouse is participating in their employer’s plan: $204,000 to $214,000

Married Filing Separately: $0 to $10,000

Of course, if you’re single and not a participant in your employer’s retirement plan, you can contribute the max of $6,000 to your traditional IRA and deduct it all from your taxable income. The same is true if your taxable income falls at or below the lower end of the ranges above. If you fall within the range, you can still contribute the maximum to your traditional IRA with no workarounds required. The caveat is that only part of your contribution will be deductible from your taxable income. And if you fall above any of the ranges, again, you can still contribute the max, but none of your contribution will be deductible.

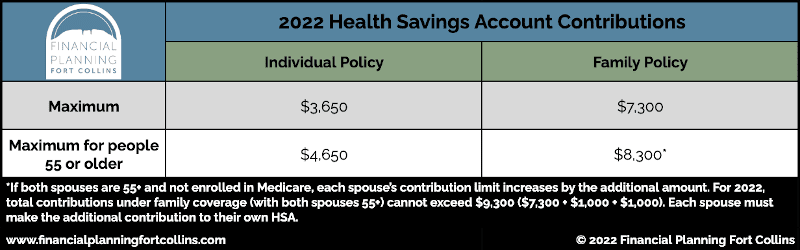

HSA Limits Inch Higher, Too

Whether you use your health savings account (HSA) to pay for health care expenses now or as an additional retirement savings vehicle, you may be happy to know that you can fit a few additional dollars into this one, too, in 2022. Limits are up by $50 for individual HSAs and $100 for family accounts. While the theme of catch-up contributions remaining the same is true for this account type as well, the $1,000 catch-up applies to those 55 and over for HSAs. Check out the HSA 2022 contribution limits below.

If you contribute to your HSA through payroll, here are the per-paycheck contributions you can schedule to reach the max.

Under 55 with Individual HSA

Biweekly pay with 26 paychecks per year: $140.39

Semimonthly pay with 24 paychecks per year: $152.09

Monthly pay with 12 paychecks per year: $304.17

Under 55 with Family HSA

Biweekly pay with 26 paychecks per year: $280.77

Semimonthly pay with 24 paychecks per year: $304.17

Monthly pay with 12 paychecks per year: $608.34

55 and Over with Individual HSA

Biweekly pay with 26 paychecks per year: $1478.85

Semimonthly pay with 24 paychecks per year: $193.75

Monthly pay with 12 paychecks per year: $387.50

55 and Over with Family HSA (not counting your spouse’s additional $1,000 contribution to their own HSA, if applicable)

Biweekly pay with 26 paychecks per year: $319.24

Semimonthly pay with 24 paychecks per year: $345.84

Monthly pay with 12 paychecks per year: $691.67

As with the retirement-specific savings accounts above, don’t forget to check with your HR department to avoid overcontributing.

Other Plan Types

If you contribute to a plan type that we haven’t discussed here — or if you contribute as both the employer and employee to your plan — let us know. We’ll help you tailor your total contribution to fit within your plan limits and show you how to spread your savings or per-pay-period contributions out through the year.

And if you’re wondering if you should contribute to the max in one of the plan types we mentioned above or if those dollars should go in another direction, we can help with that, too. Simply find a convenient time to get together!