When it comes to your charitable giving, are you sporadic or intentional? Do you give little amounts to multiple causes or narrow your contributions to a select few? Sporadic givers who give little amounts to multiple organizations may not know it, but they’re “peanut butter philanthropists.” Their noble generosity is genuine and appreciated. However, if you’re a peanut butter philanthropist, you can do better.

Think about this anecdotal example while putting yourself in the nonprofit organization’s shoes:

While working at the nonprofit, you receive a notification that someone charged their credit card to give your organization $20. You add $20 to your general operating fund. Then you have to pay the credit card processing fees, provide a tax receipt to the philanthropist, add the philanthropist’s name to the list of givers to whom you’ll send annual reports and other future requests to give more, and also put the money toward the cause that motivated the giver to give. That’s a lot of work for $20.

And as a peanut butter philanthropist, you may be giving similar $20 donations to multiple charities.

My friendly challenge to you: Improve your giving strategy so you can make a difference, instead of being an administrative drag.

* An important point to make: Small-dollar donors are sometimes heroes. Some small donations come from households that give a larger percentage of their income when compared to higher earners. However, this article is speaking to those who have the means and, more important, the desire to give in a significant, better, and more tax-efficient way.

I’ll discuss …

- the backstory on this “peanut butter” concept,

- how to narrow your focus,

- ways to commit to a giving plan, and

- How to make your dollars go further with tax-efficient giving.

What is a peanut butter philanthropist?

The Peanut Butter Manifesto was a memo shared in 2006 from a Yahoo! Senior vice president, Brad Garlinghouse. The memo was then circulated by The Wall Street Journal to bring this “peanut butter” concept into the business vernacular.

In this memo, Garlinghouse challenged the company, saying that it was ineffectively spreading money and other resources around to multiple efforts. It was spreading the resources thin — like spreading peanut butter on a piece of toast. He challenged the company to shift that mentality to redirect those resources to fewer intentional projects so the company could make some profitable and significant breakthroughs in more focused ways.

Leaders in the philanthropic space have adopted this similar peanut butter metaphor to describe the well-intentioned givers who only give small amounts to multiple organizations. While it feels good to give to multiple causes, the philanthropist misses opportunities to make significant impacts. The authors of “Give Smart: Philanthropy that Gets Results,” shared this quote in their book:

You can bring this mentality to your charitable giving strategy to make a better impact. Let’s explore how in a three-step process.

Step 1: Narrow Your Focus

A common challenge I hear when discussing charitable giving with clients is that the client doesn’t have an organization that “pulls at their heartstrings.” The client then settles into a peanut butter strategy because they want to make a difference but are unsure how. Thus, when impulsive moments happen — like when a news story breaks, a friend asks you to donate to their marathon, or another situation occurs — they give cash via e-check or credit card through a nonprofit’s giving page.

Dangent: An unexpected perk of creating a giving plan with a focus is that you can alleviate the guilt when saying “no” to these types of fundraising requests.

You may already know which organizations you prefer to focus on. But those still in the discovery phase of their philanthropic journeys need to start doing some research to find causes they care about. Take a step back and identify what makes you tick as a philanthropist.

You can do this by asking yourself three questions:

- What do I want to see more of in the world?

- What do I want to see less of in the world?

- What do I hope lasts multiple lifetimes?

When answering these three questions, you have the chance to identify certain themes that you value and that you may want to commit to in a significant way. You can then have a specific “rabbit hole” to narrow your research. Online search engines can help you find local, national, or global organizations that do work meaningful to you.

To help you in your research, here are some popular online portals. These philanthropic hubs contain ratings as well as list-focused rankings:

- National Standards for US Community Foundations: Locator

- BBB Wise Giving Alliance

- Charity Watch

- GuideStar

- Charity Navigator

- GiveWell

Client examples: Some clients add charitable giving goals to their financial plans. This means that we can identify a monetary value on which to then nudge the client to follow through. While not all clients reach this goal, I hope that, by completing the first step, they will have organizations in mind to which they’re excited to give.

And, if you need some further help identifying themes upon which to narrow your focus, learn from the United Nations’ list of Sustainable Development Goals to help you identify which causes “pull at your heartstrings.”

Step 2: Consider How You’ll Commit

In philanthropy, it’s important to remember that you have three precious resources to give. Once you identify a cause and an organization that you believe can make a deeper difference — versus a small peanut butter donation — you can investigate how you want to commit one or many of your precious resources.

Give Your Time (aka Volunteer)

You can help at a soup kitchen, mentor someone, dig ditches, rake leaves for an elderly neighbor, paint over graffiti, plant trees, deliver meals, or any other way to do meaningful — yet unglamorous — work for causes you care about. These tasks aren’t always pretty, but those volunteering to do them can save money and resources for philanthropic organizations.

By donating your time to these tasks, the paid staff can direct their energies elsewhere. Thus, the valuable resources of the organization — the skilled workers and the funds used to pay them — can benefit the public good in a more efficient manner. And, by being a frequent volunteer, the organization can begin to rely on you and offer you more responsibilities — thus making an even more significant impact.

Give Your Treasure (aka Physical Stuff)

To stay on the theme of giving significant resources (your treasure), I’m going to focus on two areas: Money and Biology.

Money

Causes require money to make a difference, and larger donations make a bigger difference. Going back to my previous example of the work a nonprofit does when receiving a $20 donation, think about how much further a larger donation goes to justify the administrative cost of being a steward of the received money. If you’re tired of being a peanut butter philanthropist, start getting real about how much you want to donate and where. This focus can help you “move the needle” in your charitable giving and in the causes you care about.

Client Examples: Regarding giving to charity, how much is an aspirational goal and how much is a realistic goal? We can help you identify within your cash-flow planning consultations and within your overall financial plan how much charitable giving makes sense for your unique situation.

Biology

Not all people have the financial resources to give significant amounts of money to philanthropic efforts. So, to instill present you with a friendly challenge, become a frequent blood donor, or register to become an organ donor. Those generous acts are significant contributions that don’t fall into the peanut butter category because, when people need those resources, these organizations make a huge difference.

Give Your Talent (aka Your Skills)

In the previous two angles of philanthropy, you give back by volunteering or giving stuff. Now it’s time to take an active role in your community — locally or globally.

You have skills that you can use to help others. You may be handy or be able to use your work-related skills to help nonprofits. Find ways to frequently help causes by contributing your skills to worthwhile causes. First, you need to analyze what skills you can lend to an organization and then identify how.

You could:

Join your local Social Venture Partners (SVP) chapter to be an engaged philanthropist as a nonprofit consultant so you can improve other nonprofits’ business infrastructures.

Serve on a nonprofit board to better a specific area.

Check out Boardnet USA and learn how nonprofits use LinkedIn to find new board members.

Ask nonprofit leaders what skills they desire from their board members.

Volunteer for your local trade association to better your profession.

For example, if you’re a dentist, type in your search bar: “<your town> dental association”. Try this with your current profession or the profession you’re seeking to enter.

Note: These 501(c)6 nonprofit organizations focus on common business interests versus community good.

If you’re a business owner, donate a portion of your business efforts to a nonprofit.

Reach out to leaders of nonprofits and/or local community organizations and ask where they recommend you contribute with the skills you have.

Step 3: Take Action!

Put your newly created giving plan into action and find ways to let your efforts and dollars go further! Instead of giving a little in a sporadic fashion, commit to making significant contributions to fewer causes — either by committing more time and talent to your causes or by donating more. By doing this, you can better leverage some tax-efficient ways to donate to charity.

One Simple Way To Have Your Dollars Go Further

One way to shift your mindset is to try not to give cash from your credit card or checking account. Instead, try to give appreciated assets so you can avoid capital gains taxes — thus giving more money to your cause and paying less in taxes.

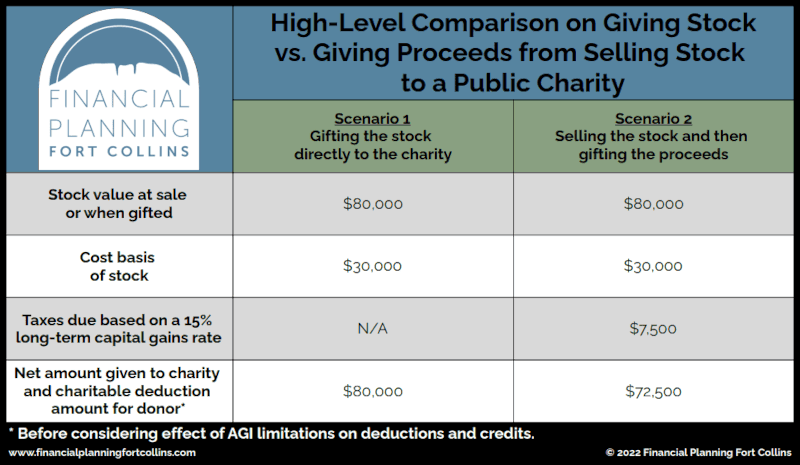

To provide a high-level example: Say that Jordan wants to give an $80,000 stock position to their favorite charitable cause this year. They paid $30,000 to acquire this stock several years ago. Jordan and the charity can both benefit with a little planning.

As you can see in this example, giving the stock to charity allows Jordan to direct more money to the charity and also prevent a taxable event if they were to sell the stock position.

More Ways to Give Better

To improve your overall charity giving plan so you can make a better impact on the causes you care about, check out our upcoming webinar, Strategies for Tax-Efficient Giving.

Two experts from Schwab Charitable will present timely tax-smart strategies to maximize your charitable giving impact. Topics include:

- Charitable trends and the current giving environment

- Five tax-efficient charitable giving strategies in 2022

- The Schwab Charitable Giving Guide, a comprehensive tool that helps you build a strategic giving plan

- Additional philanthropic resources to help you and your family maximize your charitable impact

Since this is a webinar, no snacks will be provided. And if we were going to provide snacks, you could be certain that we would’ve offered something with peanut butter! We look forward to seeing you at the webinar, and please let us know if you want to have a more in-depth conversation about charitable giving!